Skip to main content

E-Verify Frequently Asked Questions (FAQ)

- Last updated

-

-

Save as PDF

E-Verify General FAQs

-

When is the earliest I can create a case in E-Verify?

- Answer: You may create a case in E-Verify for an employee whose first day of employment is up to 90 business days in the future. The employee’s first day of employment is the date the employee began (or will begin) work for pay. This date appears in Section 2, Certification on Form I-9 next to the employee’s first day of employment (mm/dd/yyyy).

The ability to select a future first day of employment does not change any policy, including the rule that prohibits prescreening. A prospective employee must have accepted an employment offer before you may complete Form I-9 and create a case in E-Verify.

-

An employer did not create cases in E-Verify for several years. The employer is again using its E-Verify account and creating cases. Should the employer create cases for employees that were hired while the employer was not using E-Verify?

- Answer: Unless an employer is a federal contractor with a federal contract containing the FAR E-Verify clause, it cannot use E-Verify for existing employees. Employers should not go back and create a case for any employee hired during the time its account was inactive and there was deliberate non-use of E-Verify. An employer who learns that he or she has failed to create a case in E-Verify by the third business day after the employee’s first day of employment should immediately create a case for the employee. In this case, however, the employer’s account was inactive due to deliberate non-use while hiring several hundred employees over several years. This employer should not go back and create cases for these employees since they are no longer new employees.

-

Does an E-Verify case have to be closed within three days of the employee's start date?

- Answer: No, the 3-day rule for E-Verify is that an E-Verify case must be submitted within three federal business days of the hire's start date, NOT that it must be closed within three federal business days. This is because some cases may take several days or even weeks to be closed if there is an issue with the information resulting in a TNC, or if E-Verify needs more time to review the case's information. However, once an E-Verify case has received a final result, the case must be closed as soon as possible.

-

Can I submit E-Verify cases for individuals hired prior to my use of E-Verify?

- Answer: Unless an employer is a federal contractor with a federal contract containing the FAR E-Verify clause, it cannot use E-Verify for existing employees who were hired prior to the effective date of the employer’s MOU.

-

Can I create an E-Verify case when a receipt is currently being used in place of their actual document?

- Answer: No, if the employee presents an acceptable receipt for Form I-9 showing that he or she applied to replace a document that was lost, stolen, or damaged, the employer must wait to create a case in E-Verify. When the employee provides the actual document for which the receipt was presented, or other Form I-9 documentation from the List of Acceptable documents, the employer must update the employee’s Form I-9 and then create a case in E-Verify for the employee. Additionally, the Tracker I-9 system will not allow an E-Verify case to be submitted for a Form I-9 record if a receipt box is checked in Section 2 of the Form I-9.

- Relevant E-Verify Resources:

-

If an employer acquires new employees through a merger or acquisition and chooses to treat those employees as new hires, may the company create a case in E-Verify for those employees?

- Answer: Yes, employers who acquire another company or merge with another company may choose to treat employees who continue being employed with the related, successor, or reorganized employer as new hires. The employer must complete new Forms I-9, and create cases in E-Verify for all of these employees within three business days of the employee’s first day of employment. Employers should enter the date of acquisition or merger as the date these employees began employment in Section 2 of their new Forms I-9.

Employers may complete Form I-9 and create a case in E-Verify before the merger or acquisition takes place as long as the employer has offered the acquired employee a job and the employee has accepted the offer. In order to avoid the appearance of discrimination, these employers must complete new Forms I-9 for all acquired employees, without regard to actual or perceived citizenship status or national origin. E-Verify employers must create a case for all acquired employees to meet the E-Verify Memorandum of Understanding provision that prohibits selective use of E-Verify and requires the use of E-Verify for all new employees.

-

In order to be compliant with the E-Verify three-day rule and company operating time zones, under which time zone does E-Verify process cases?

- Answer: E-Verify cases are recorded in Coordinated Universal Time (UTC) regardless of the time zone the case is created in. E-Verify allows for a full three days from this recorded case creation date when computing if a case is created within three days of the hire date. Employers may attach a note on the Form I-9 indicating time zone discrepancy for cases that may appear late.

- E-Verify FAQ Link

-

What does an invalid value for a country code error message mean?

- Answer: The E-Verify system will present this error message with a list of acceptable country codes when a code is used that they do not accept. This is due to the inconsistencies between USCIS rules for the Form I-9 that allow a larger selection of options for the issuing country for a foreign Passport, and E-Verify's more limited list of acceptable countries. The most common example of this is a Hong Kong Passport. While the USCIS allows Hong Kong to be used as the country of issuance for a Foreign Passport on the Form I-9, E-Verify does not allow Hong Kong (HKG) to be used as the country for the E-Verify case. The solution for this, per E-Verify's compliance organization, is to use China as the country for the E-Verify case, which may be edited on the E-Verify Preview Page where an error message appears. However, Hong Kong may remain in use for Section 2 of Form I-9. See "Invalid Value for Country Code" Error.

-

Why can't we submit an E-Verify case if the value in one of the name fields exceeds 25 characters?

- Answer: USCIS E-Verify's system imposes a 25-character limit on all name fields and will not allow an E-Verify case if the names included in one of these fields exceed a total of 25 characters in length. The guidance from USCIS E-Verify Support is that additional names can be moved to different name fields, such as Other Names, and they suggest reviewing the documents provided to try to identify which names should be moved.

-

What does it mean if my employee receives a Tentative NonConfirmation (TNC)?

- Answer: A TNC case result means the information entered into E-Verify from an employee’s Form I-9 does not match Social Security Administration (SSA) records and/or records available to the Department of Homeland Security (DHS) and must be resolved. Please confirm with the employee that the information entered is correct.

You must complete the TNC referral process within 10 federal government working days after E-Verify issues the TNC result. Instruct the employee that they must tell you their decision by the 10th federal government working day after E-Verify issued the TNC result, or you will close the case in E-Verify. If the information entered is correct, please close the case and resubmit a new case.

Employees who receive a TNC from both the Department of Homeland Security (DHS) and Social Security Administration (SSA) and inform their employers that they will take action on their case have 8 federal government workdays to contact both agencies to contest the mismatch. The employer should download and print the Further Action Notice and provide it to the employee. This Further Action Notice (FAN) provides instructions for the employee on how to contact DHS and visit SSA in person to resolve the TNC. The employee has 8 federal government workdays from when the case is referred to contact that agency to resolve the mismatch. The employee may continue to work while resolving the mismatch. For more information, review the E-Verify User Manual.

You should check E-Verify periodically for case result updates. You may not terminate or take adverse action against an employee because of the TNC while SSA or DHS is reviewing the employee’s case.

-

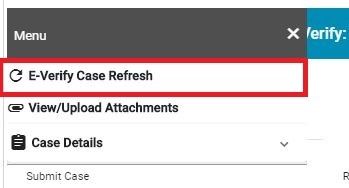

I have an E-Verify case that has been in continuance or referred for a while and hasn't received an update. How can I check if there are any updates on the case?

- Answer: If you have a case that is currently waiting for an update, it is in the continuance or has been referred for an employee to contest TNC results, and you are concerned that it may be out of sync, you may have the system check for an update from E-Verify at any time. This can be done by selecting the E-Verify Case Refresh options from the menu for the E-Verify case. See How to Refresh an E-Verify Case.

-

Can a case that has been referred for the employee to contest a Tentative Nonconfirmation (TNC) result be closed?

- Answer: Unfortunately, no, USCIS E-Verify does not allow referred TNC cases to be closed until after they are updated with final case results. You will not be able to close the case until the agency that issued the TNC (DHS and/or SSA) updates the case with a final result after the employee contacts them, or the case receives a final No Show result. Additionally, the agency that issued the TNC (DHS and/or SSA) can take up to 10 federal government working days from the referral due date to update the case with a final result.

-

My employee received a Tentative NonConfirmation (TNC) and was terminated for unrelated reasons or quit. Why is the E-Verify case still open?

- Answer: Terminating an I-9 record does not close any open case for that I-9; open E-Verify cases must be completed and closed by a user.

- If the Tentative NonConfirmation (TNC) has already been referred for the employee to contest the TNC, you will not be able to close the case until it receives a final result, see question 11 above.

- If the Tentative NonConfirmation (TNC) has NOT already been referred, you may select that the former employee will not contest the TNC result. This will result in a Final Non-Confirmation result, and you may close the case.

-

Can I undo an action taken on an E-Verify case, such as selecting the wrong option on a Photo Match or referring to a Tentative Nonconfirmation (TNC) case when it should not have been?

- Answer: No, USCIS E-Verify does not allow actions taken on cases to be undone or for you to go back to earlier completed steps in the process.

-

Can I delete an E-Verify case?

- Answer: No, USCIS E-Verify does not allow E-Verify cases to be deleted. However, you may submit a new E-Verify case for the same I-9 after the existing case has been closed, if needed.

-

Will changes I make to a Form I-9 record after the E-Verify case has been submitted be applied to the open E-Verify case?

- Answer: No, USCIS E-Verify does not allow changes to the data in an open E-Verify case. The only exception is if the E-Verify case is on an Are You Sure step, and E-Verify asks that you review that specific piece of information. If the E-Verify case was submitted with incorrect information, the case will have to be closed when able and a new case submitted. Please see our Case Submitted with Incorrect Information article for more information.

-

If my hire's start date changes after I submit an E-Verify case, what do I need to do?

- Answer: USCIS E-Verify does not allow the start date to be changed for an E-Verify case after its submission. Per USCIS E-Verify Support, you do NOT need to run a new E-Verify case if the only change is the start date. Instead, they recommend that you record a note on the record identifying that the date changed and why it changed. In the Tracker I-9 system, this can be done using the Custom Audit Note feature on the summary tab of the I-9. Please see our How to Create a Custom Audit Note article for more information on recording Custom Audit Notes.

-

Does an employer need to sign a new MOU signature page if the original MOU signatory is no longer with the employer, or if they want to change the MOU signatory?

- Answer: Employers who are already enrolled do not need to execute a new MOU. However, as a reminder, when the signatory leaves, the employer continues to be bound to the terms and conditions of the most recent version of the MOU and E-Verify User Manual. A company does not need to re-enroll into a new account if the original MOU signatory leaves. Once signed, the MOU cannot be changed nor the signatory updated. Having an MOU with a defunct signatory does not impact compliance with E-Verify. The only way to update to a signatory would be to terminate the current account and establish a new one, which would be unnecessary unless the company needs to change its access type.

-

Does Mitratech and the Tracker I-9 team receive advanced notice when E-Verify will introduce new features or make changes to the E-Verify system?

- No, while Mitratech and the Tracker I-9 team would love for E-Verify to give us advanced notice of the changes they make to the E-Verify system, we learn of changes to the E-Verify system at the same time as the rest of the public.

-

Will the E-Verify system issue TNC results for new E-Verify cases that contain revoked I-766 Employment Authorization Document (EAD) cards?

- Answer: From USCIS E-Verify Support: "Any time that a new E-Verify is created with a revoke EAD, Category C11 for Cuban, Venezuela, Nicaragua, or Haiti, you will receive a tentative nonconfirmation. This gives the employee an opportunity to resolve the issue."

- Please be aware that Mitratech and the Tracker I-9 System do not control the behavior of E-Verify's systems, and we can not guarantee or change its behavior.

-

Can I create new E-Verify cases every time I reverify an employee?

- Answer: No, E-Verify's rules are clear that employers may not create new E-Verify cases when reverifying an employee's expired employment authorization documents.

- E-Verify and Form I-9

- "E-Verify MAY NOT be used to reverify expired employment authorization"\

- Employee Rights and Responsibilities

- "An employer that participates in E-Verify MUST NOT: Use E-Verify for reverification if you are an existing employee whose temporary employment authorization has expired. Your employer must complete Supplement B, Reverification and Rehire, of Form I-9 when reverification is required.

E-Verify and U.S. Federal Government Shutdowns

-

Does the U.S. Federal Government Shutdown impact E-Verify case processing?

- Answer: Yes, during a U.S. Federal Government Shutdown the E-Verify system, operated by the Department of Homeland Security (DHS) and United States Citizenship & Immigration Services (USCIS), will be down and E-Verify will not be available. Employers will not be able to submit or process E-Verify cases while E-Verify is down, this includes but is not limited to:

- Submitting new E-Verify cases.

- Confirming information on the Are You Sure prompts for open E-Verify cases.

- Confirming Photo Match prompts for open E-Verify cases.

- Downloading Further Action Notices (FAN) for cases with Tentative NonConfirmations (TNC) for open E-Verify cases.

- Referring Cases with NC results for the employee to take action and contest the TNC result for open E-Verify cases.

- Downloading TNC referral confirmation letters for open E-Verify cases.

- Closing E-Verify cases.

-

Will Employers be able to submit and process E-Verify cases after the U.S. Federal Government Shutdown ends?

- Answer: Yes, after the U.S. Federal Government reopens and E-Verify is restored, employers will be able to submit and process E-Verify cases again. Upon the restoration of E-Verify services after the shutdown, the Mitratech Tracker I-9 Support Team will provide clear instructions on how to process the backlog of E-Verify cases, based on guidance from E-Verify and USCIS.

-

How will the U.S. Federal Government Shutdown impact Tracker I-9 functionality?

- Answer: During a U.S. Federal Government Shutdown, all E-Verify case processing will be unavailable. If an I-9 Manager attempts to submit a new E-Verify case, or take action on an existing E-Verify case, then they may experience the following:

- An error message displayed on the page

- A page not rendering completely or is unresponsive

- Unable to advance to the next step within the E-Verify workflow

- All other, non-E-Verify, functions and features of the Tracker I-9 system, including but not limited to Form I-9 processing, will still be operational and available.

-

Are employers still required to process and complete the Form I-9 for new hires during a U.S. Federal Government Shutdown?

- Answer: Yes, employers are still required to complete the Form I-9 within 3 business days of an employee's hire date during a U.S. Federal Government Shutdown.

-

Is the E-Verify 3-day rule still in effect during a government shutdown?

- Answer: No, normally, E-Verify will suspend the 'three-day rule' for E-Verify cases is suspended for cases affected by the shutdown. E-Verify will provide additional guidance once normal operations are restored.

- This does NOT affect Form I-9 requirements - as mentioned above, employers must still complete the Form I-9 no later than the third business day after an employee starts work for pay. Employers must comply with all other Form I-9 requirements.

-

Can employers still take advantage of the DHS-authorized Alternative Procedure for remote document inspection?

- Answer: Yes, Employers who are using an alternative procedure authorized by DHS to perform a remote examination of employee Form I-9 documents may continue to do so if they remain enrolled in good standing in E-Verify during the lapse in Department of Homeland Security appropriations.

-

Does E-Verify extend the TNC contestation period during a U.S. Federal Government Shutdown?

- Answer: Yes, normally, E-Verify and DHS will extend the timeframe during which employees may resolve TNCs during a U.S. Federal Government Shutdown. The number of days E-Verify is not available will not count towards the number of days employees have to begin resolving their mismatches. E-Verify will provide additional guidance for these deadlines once they reopen.

-

Can I enroll in E-Verify, update my E-Verify account information, or request a copy of my E-Verify MOU during a U.S. Federal Government Shutdown?

- Answer: No, the E-Verify system is completely down and inaccessible during a U.S. Federal Government Shutdown. New E-Verify enrollments cannot be processed, and existing E-Verify accounts cannot be accessed and information, including MOUs, cannot be collected or updated by Mitratech while E-Verify is down.

-

Does Mitratech receive advanced information regarding the timeline for a U.S. Federal Government Shutdown?

- Answer: No, the Federal Government does not share information with Mitratech before it is shared with the public. We learn all information about shutdowns, outages, and policy changes at the same time as the rest of the public.

-

Can cases or questions be escalated with E-Verify during a U.S. Federal Government Shutdown?

- Answer: No, during a U.S. Federal Government Shutdown, all of E-Verify's system and support staff are offline and Mitratech cannot view any E-Verify cases or escalate any cases or questions to E-Verify Support until the shutdown ends and E-Verify's systems and operations restored.