Lawtrac Spend Management

Lawtrac 4.1 introduced Lawtrac Spend Management, an integration between Lawtrac and Collaborati. The e-Billing portal Collaborati is an optional, secure, Web-based application used by outside counsel and other vendors to submit electronic invoices and rate requests. The application allows law firms and vendors to collaborate with Lawtrac clients via a single portal and receive real-time status updates and other feedback from your attorneys.

This help section provides instructions for completing the setup process that is needed for establishing the proper workflow between your Lawtrac application and Collaborati. The Collaborati setting exists in your Lawtrac Application Administration | Application & Database, and can be enabled or disabled based on client system needs. The features displayed for the law firms and vendors depend on settings and permissions deemed relevant by the Lawtrac client. Through Application Administration, super users can access the Collaborati Settings page and view the status of features Lawtrac sent to Collaborati, such as:

- Rate collaboration

- Rate sharing

Future upgrades of Lawtrac will address budget and tender collaboration.

Access the General e-Billing F.A.Q.

Setting up Collaborati

Mitratech suggests users ensure all invoices have been approved before the connection between Collaborati and Lawtrac is established.

Mitratech Support creates the client and vendor accounts in Collaborati. When Mitratech Support adds the client and vendor to Collaborati, the administrators listed for the account are notified by email with the URL and login credentials. These credentials are entered into the Collaborati Settings page by your Lawtrac super user in order to sync information to and from Lawtrac and Collaborati. Vendors log directly in to Collaborati.

Lawtrac must first be scheduled to sync with Collaborati in order to complete this integration. Super users configure this sync through Application Administration | Application & Database | Scheduled Tasks. It is best practice to designate a Lawtrac Spend Management administrator to handle these tasks. This individual can request LawManager Spend Management training from a Mitratech business executive.

If your outside counsel is using Collaborati to submit invoices, they still have the opportunity to submit invoices via the Lawtrac application, unless this function is manually disabled by a Lawtrac system administrators or super user. The setting to control this function exists in the LAWTRAC.LTO settings file, which is in the root folder where your Lawtrac is installed. Click here for instructions.

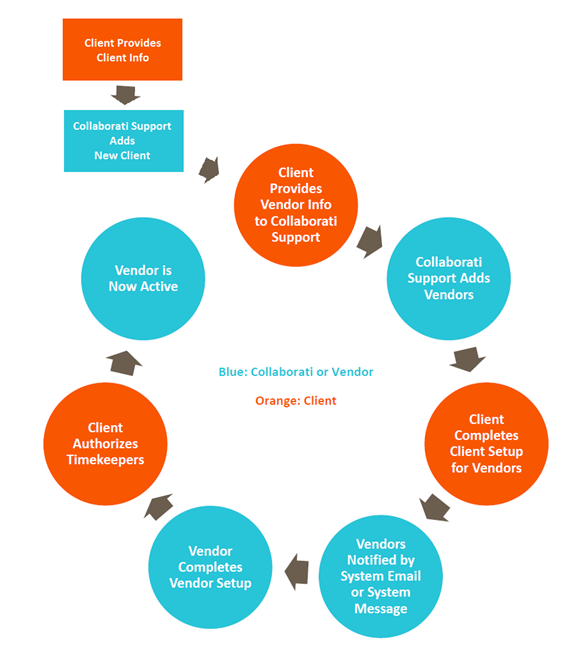

Below is a diagram of the basic client and vendor relationship with Collaborati Support during the set-up process:

How Do I Work with Collaborati as an In-House Legal Team User?

Collaborati is exclusively vendor-facing, and many of the transactions are carried out by a Mitratech Support administrator. As an in-house Legal team user, you can associate Collaborati vendors with Lawtrac vendors. For an in-depth explanation of this process, refer to Collaborati Vendor Tab.

How Do I Work with Collaborati as a Law Firm or Vendor?

Once your status is "Active" in Collaborati, you can submit rates and invoices. Access the Collaborati User Guide by selecting the Help link at the top right corner of the Collaborati home page after logging in.

Note: If you are outside counsel who is submitting an invoice, do not submit taxes or the invoice will be automatically rejected (this behavior excludes invoice line items using a custom client code for taxes, which is configured by the Lawtrac site administrator or super user).

Important Note: Timekeepers using Collaborati cannot submit rate requests that contain multiple matter-specific and non-matter-specific line items if there are conflicting or overlapping dates. Rate requests submitted with such line items will be automatically rejected by Lawtrac.

Advanced Processing Rules

Lawtrac super users manage the advanced processing rules for the Lawtrac application via Application Administration | Finance Options | Processing Rules | Advanced Processing Rules. These rules apply to LEDES invoices submitted through Lawtrac as well as all invoice types received through Collaborati. For law firms and vendors who use Collaborati, the advanced processing rules apply after the invoice has been received by Lawtrac.

Note: Current Lawtrac behavior also applies advanced processing rules to LEDES invoices submitted manually in Lawtrac. Regular processing rules do not apply to invoices submitted to Lawtrac through Collaborati.

Advanced processing rules that apply to invoices submitted through Collaborati:

- R101: Check individual timekeeper assignments.

- R102: Automatic timekeeper assignment.

- R200: Validate timekeeper rate card.

- R201: Validate task code maximum amount per invoice.

- R203: Check maximums at the matter level check.

- R204: Check restricted task codes.

- R205: Check required codes.

- R300: Check duplication of specific lines within an invoice.

- R400: Measure Invoice-to-combined budget per matter.

- R401: Measure Invoice-to-firm's budget per matter.

- R402: Measure Invoice-to-fiscal reserves per matter.

- R500: Work within invoice's "From/Start" and "To/End" dates.

- R501: Ensure invoices reflect fiscal year settings.

- R502: Set penalties for late reporting.

- R503: Account for inconsequential events.

- R504: Flag line items billing 10+ hours per day/timekeeper/invoice/matter.

- R600: Flag non-billable disbursements by word or phrase.

- R601: Flag non-billable fees by word or phrase.

- R602: Negate fees for non-billable disbursements.

- R603: Negate fees for non-billable fees.

View a full description of these rules in the Advanced Processing Rules page.

Note: R100 (block invoices from released firms) is not applicable, because Collaborati requires that the firm is assigned to a matter in order to submit an invoice.