Taxes

Taxes on fees and expenses are supported in eCounsel. Each detail line on the invoice is identified as taxable or non-taxable, and the taxes are summarized based on taxable fees or taxable expenses at the matter level. If LEDES 1998BI and LEDES 2000 files contain tax information, the tax information will be imported into eCounsel along with the other imported information.

LEDES 1998BI and LEDES 2000 formats support single jurisdiction taxes only.

LEDES 1998BI and LEDES 2000 formats support single jurisdiction taxes only.

When manually entering or editing invoices, beginning with Service Pack 12, multiple jurisdiction taxes are supported for the same Tax ID. You must calculate the taxes on each matter tax detail record intially and when any new line items are added to the invoice. The tax information can be filtered by jurisdiction company on the Invoices Summary page.

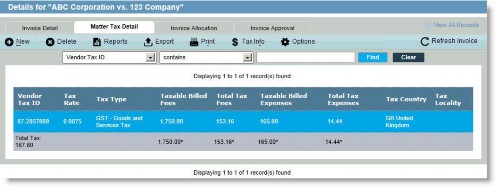

The Invoices Matter tab features a Matter Tax Detail subtab:

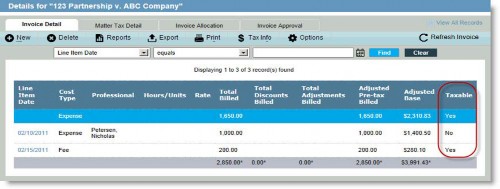

A Taxable field on the Invoice Detail subtab on the Matter tab:

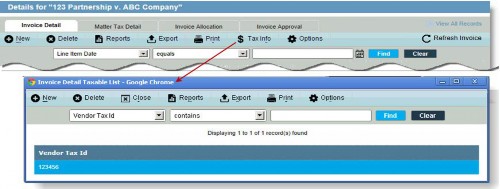

And, a Tax Info button has been added to the Invoice Detail subtab toolbar to open the Invoice Detail Taxable List dialog box to identify the vendor’s tax identification number with the taxing authority:

The creation of a record on the Invoice Detail Taxable List dialog box automatically sets the invoice detail record Taxable field to Yes.