This page acts as an index for all of the eBilling Rules and Guidelines available in TeamConnect Essentials. It also details the order in which the billing rules are applied when running against an invoice.

What are Invoice Audit Rules?

One of the main benefits of an eBilling solution is the automated auditing of invoices against company and firm-specific billing guidelines. A list of comprehensive, best-practice rules exist in TeamConnect Essentials that allow users to optimize their electronic invoice import process to automatically reject, automatically adjust, or flag with a warning line items in an invoice that do not conform to the set billing guidelines (audit rules).

Setting billing audits and communicating those to your firms ensures you are both clear on billing expectations. By using billing audits, you are able to identify firms that consistently follow billing guidelines as well as those who don’t and avoid billing discrepancies such as duplicate invoices and charges. Billing audits reduce outside counsel costs, improve matter oversight, increase billing efficiency and promote better communications with outside counsel.

Audits performed in eBilling portal

Mitratech’s eBilling portal is Collaborati.

Prior to your legal department receiving an electronic invoice, audits are performed within Collaborati. These basic audits are in place to eliminate invoices received and reviewed by your legal department that contain basic billing errors.

These audits are applied to both electronic invoices uploaded into Collaborati as well as invoices manually created in Collaborati.

| Audit Name |

Description |

| Syntax Validation |

The LEDES invoice uploaded by a vendor conforms to LEDES format |

| Data Type Validation |

The data submitted is in the correct format (for example, dates are submitted in a date format) |

| Client Validation |

The client has approved the vendor to bill to that matter |

| Invoice Number |

Invoice number is specified and represents a unique ID against the vendor invoice data already present in Collaborati |

| Date Validation |

Invoice dates are specified, valid, and chronologically consistent |

| Validation of Line Item Units |

Required line item unit values are specified (for example, number of hours is entered on the invoice) |

| Validation of Codes |

All codes used in the invoice and existing codes and authorized by the client

Learn more about LEDES eBilling codes here.

|

| Validation of Timekeepers |

All timekeepers specified in the uploaded file are existing timekeepers and authorized by the client |

| Validation of Line Item Totals |

The total line item amount is consistent with the rate and unit values |

Note: Click here to see the online User Guide for Collaborati

Where can I enable or disable the audit rules in my system?

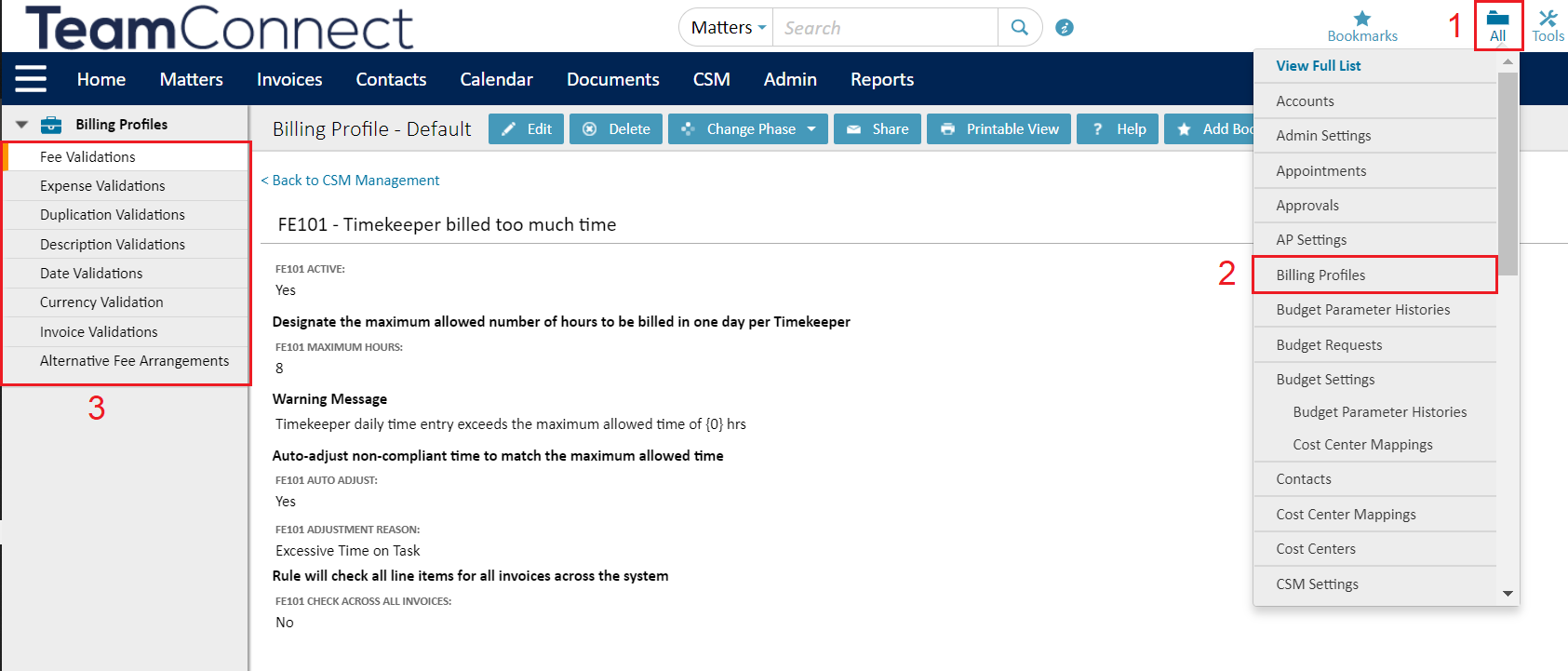

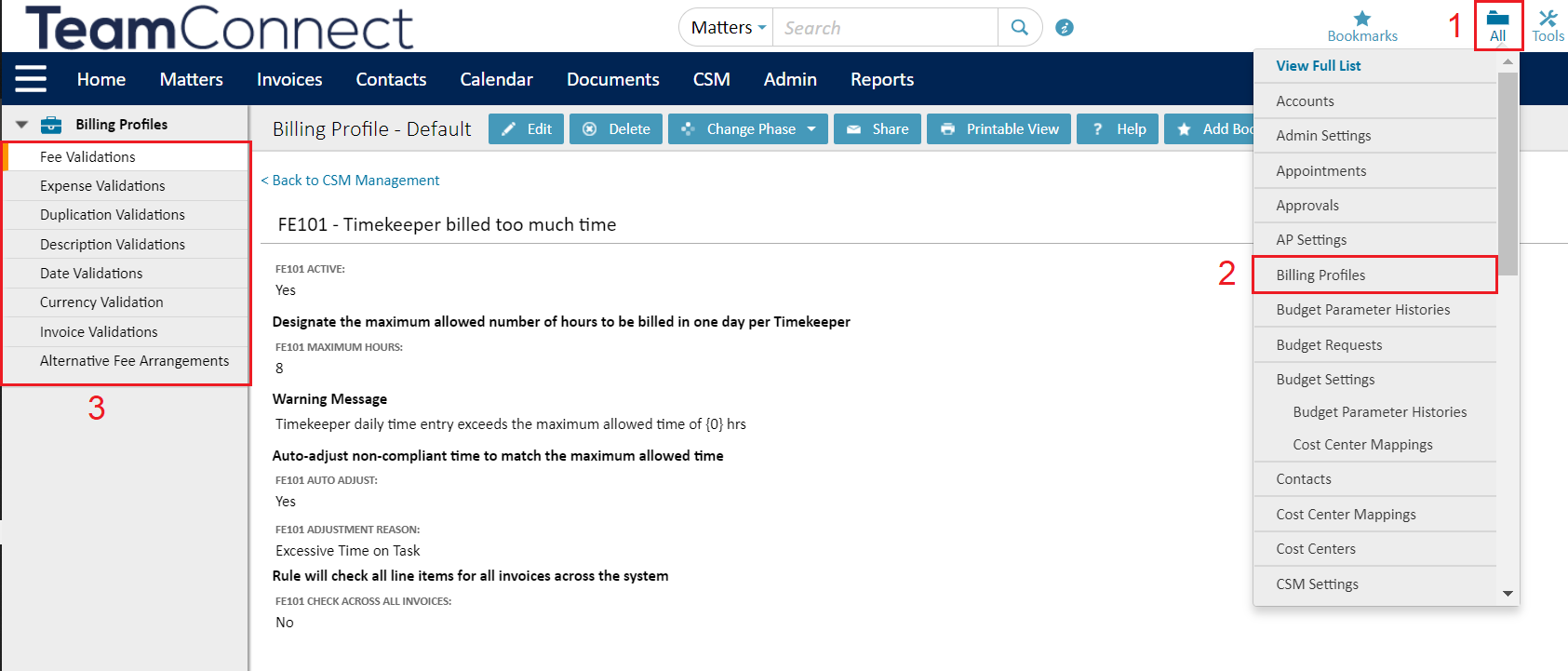

You must be an eBilling Admin to enable or disable the eBilling rules. To edit, log in as an administrator, select the All menu then select Billing Profiles.

Click the Edit button to enable or disable the respective rules.

Invoice Audit Rules Index

The table below defines all of the rules that ebilling and CSM administrators can enable or disable for invoices.

| Billing Profile & Description |

Audit Rules & Definitions |

|

Fee Validations

|

- FE101 Timekeeper billed too much time - Verifies if any Timekeeper on an invoice is billing for more hours than the maximum (configurable) amount set by the invoice administrator.

- FE102 Fee charges exceed agreed rate - Validates if any line item on an invoice contains a fee that exceeds the stored rate for that Timekeeper. When this rule is enabled, the system either gives a warning on the line items or adjusts the line item to the agreed rate when a discrepancy is found, and includes hierarchy of rate checking (if applicable).

|

|

Expense Validations

|

- EX101 Expense line item amount maximum exceeded - The line item amount of any expense cannot exceed a specified amount calculated by multiplying rate * units total.

Note: This is an upper limit for any expense item and does not limit at a code level.

Verifies if any expense charge on a line item in an invoice exceeds the maximum amount. When this rule is enabled, the system gives a warning on the line items, and can be configured to auto-adjust the line item containing the conflict to zero when a discrepancy is found. Administrators can decide if they want the adjustment reason to be sent to the outside counsel.

- EX102 Expense line item unit maximum exceed - The line item units of any expense cannot exceed a specified amount.

Note: This is an upper limit for any expense item and does not limit at a code level.

- EX103 Expense charges exceed acceptable costs - Unit costs exceeds expense unit prices established by your legal department. Verifies if any line item on an invoice contains an expense that exceeds acceptable cost . When this rule is enabled, the system either gives a warning on the line items or adjusts the line item containing the conflict to zero. Your administrator can set what an acceptable cost means for each expense code through the Expense Unit Prices Tool.

|

|

Duplication Validations

|

- DP101 Invoices contain duplicate Timekeeper charge - Configurable fields to validate against (line item date, project, timekeeper, task code, quantity).

- DP102 invoice contains duplicate expense - Configurable fields to validate against (line item date, project, expense code, quantity)

Note: Expenses are not timekeeper related

-

Verifies if any line item on an invoice contains a duplicate expense. When this rule is enabled, the system either gives a warning on the line items or adjust the line item containing the conflict to zero when a discrepancy is found. This rule can be enabled to check for duplicate expenses for all invoices sent by that vendor.

When setting up the duplicate expense audit rule, the following fields can be checked for duplication:

- Matter

- Line Item Date

- Expense Code

- Quantity

|

|

Description Validations

|

- DS101 Line item missing description - The line item description on each line must contain a value

- DS102 Invoice missing description - Validated against the Invoice Description field in the LEDES invoices for a value

- DS103 Invoice line item description contains keyword - Configurable keywords. This rule checks each line item's description on an invoice for a keyword(s) set by your administrator. When this rule is enabled, the system either gives a warning on the line items or adjust the line item containing the conflict to zero when a discrepancy is found.

|

|

Date Validations

|

- DT101 Invoice is too old - Configurable number of days. Verifies if the invoice date on the invoice doesn't exceed the amount of days set by your administrator. When a conflict has been found, the invoice is auto-rejected and sent back to the outside counsel.

- DT102 Billing period end date missing - Service end date must contain a value

- DT103 Billing period start date missing - Service start date must contain a value

- DT104 Invoice service/expense charges are too old - Configurable number of days

- DT105 Line item date does not fall within billing period dates - Compares the detail line item date to ensure it falls within the invoice service start date and service end date for all line items (excludes invoice-level fee discounts and invoice-level expense discounts)

- DT106 Line item date greater than current date - Validates if the date specified on a line item is greater than the current date (today's date)

|

|

Currency Validation

|

- CR101 Invoice does not match vendor currency - The invoice currency must match currency on file for your company. Verifies if the currency used by the invoices matches the currency set by the vendor. When this rule is enabled, the invoice is automatically rejected and sent back to the outside counsel firm or vendor when a discrepancy is found.

|

|

Alternative Fee Arrangements

|

- Fixed Fee Matter-based AFA Validation - Warning when the invoice violates fixed fee agreement on the matter

- Ignore Hourly Rate validation when active - Warning when a fee amount exceeds the Fixed Fee amount

- Capped Fee Matter-based AFA Validation - Warning when the invoice violates capped fee agreement on the matter

- Include expenses in total calculation - Allow expenses to be included in the total calculation

- Volume Discount Vendor Based AFA Validation - Warning when a discount is incorrectly entered on an invoice

|

| Invoice Validations |

- IN101 Purchase Order Number Validation- Will warn or reject invoice if the rule is turned on and the invoice is missing a PO number. Verifies if the PO Number field is filled in when an invoice is submitted from Collaborati. When this rule is enabled, the invoice is either accepted with a warning or rejected and sent back to the outside counsel firm or vendor when a PO number is missing.

|