Adopting LEDES and UTBMS standards for eBilling

LEDES

What is LEDES?

LEDES stands for Legal Electronic Data Exchange Standard.

This is a set of specifications enabling uniform data transmission throughout the legal industry. LEDES specifications were created by the LEDES Oversight Committee (LOC). This committee formed in 1995, involves representatives from the American Bar Association, the Association of Corporate Counsel and PricewaterhouseCoopers. The group is now comprised of a variety of law firms, corporate legal departments, universities and software vendors. These standards enable collaboration amongst systems and increase consistency across the industry.

There are four frameworks of data exchange maintained by the LOC. These are:

- Electronic Billing (e-billing)

- Budgeting

- Timekeeper Attributes

- Intellectual Property (IP) Matter Management

LEDES standards are globally considered leading practice for exchange of legal e-billing information. There are several different formats to accommodate various firm/counsel needs, but all are based on the exchange of the same core information.

What is a LEDES file?

A LEDES file is an invoicing format that supports hourly billing, flat fee billing, expenses, multiple currencies and tax. This file can be created by a large variety of time and billing systems. This is a standardized invoicing format that brings increased visibility to the invoicing process. The most used format in the United States is the LEDES 1998B version. Click here to view a list of all the formats and what they provide, you will also find sample LEDES invoice structure for reference.

The codes used in these invoices are UTBMS codes. To read more about them, click here.

What is the benefit of using LEDES Files?

Time and billing systems that generate LEDES files and most e-billing solutions encourage the submission of LEDES files as a leading practice in the industry. On the law firm side of things, the main benefit of using LEDES Files is for ease and time savings associated with submitting a universal format to all clients. Firms no longer have to submit a unique invoice formats to each of their clients. This also reduces the amount of time spent creating invoices and creating task descriptions.

For your company, adopting this format widely will save time and money. Processing invoices will only become easier as you adopt this standard way of reading all invoices. You will also benefit from improved legal spend analysis. Your company will be able to more easily understand where and how money is being spent and compare billing across comparable firms to control cost.

LEDES Formats

The table below details LEDES formats

| LEDES 1998B |

The original LEDES format is LEDES 1998. This format is no longer available and was replaced quickly by LEDES 1998B. This format has 25 fields and is the most used ebilling standard in the US legal industry. The format is not going to be updated in the future. See format below. INVOICE_DATE|INVOICE_NUMBER|CLIENT_ID|LAW_FIRM_MATTER_ID|INVOICE_TOTAL|BILLING_START_DATE|BILLING_END_DATE|INVOICE_DESCRIPTION|LINE_ITEM_NUMBER|EXP/FEE/INV_ADJ_TYPE|LINE_ITEM_NUMBER_OF_UNITS|LINE_ITEM_ADJUSTMENT_AMOUNT|LINE_ITEM_TOTAL|LINE_ITEM_DATE|LINE_ITEM_TASK_CODE|LINE_ITEM_EXPENSE_CODE|LINE_ITEM_ACTIVITY_CODE|TIMEKEEPER_ID|LINE_ITEM_DESCRIPTION|LAW_FIRM_ID|LINE_ITEM_UNIT_COST|TIMEKEEPER_NAME|TIMEKEEPER_CLASSIFICATION|CLIENT_MATTER_ID[] |

| LEDES 1998BI |

This format was added as a LEDES format in 2005. It was created as an ebilling standard for the legal service industry in the UK. This format is a more detailed version with 51 fields. The additional fields add more detailed information surrounding Law Firm location and address, Client location and address, Tax, Currency and Timekeeper Information. |

| LEDES 2000 |

This standard is in XML, it contains more information than the original LEDES 1998B format and does a better job of accommodating AFAs (Alternative Fee Arrangements). LEDES 2000 XML has 125 fields and is split up into 7 segments. These segments are:

|

| LEDES XML 2.0 |

LEDES XML 2.0 is an update to LEDES 2000. Additions to this format include: calculation changes, capability of itemizing complex taxes, alternative fee arrangements, credits and debits on a matter and it support multiple tax ID numbers. The format also uses more consistent terminology. The format has 153 fields and is split into 15 segments. These segments are all of the 7 LEDES 2000 segments, plus: Tax Tax Summary Matter Discount Credit Tax Matter Discount Credit Fee Item Discount Credit Tax Item Fee Expense Item Discount Credit Tax Item Expense |

| LEDES XML 2.1 |

This update was made because third party ebilling systems were using different math logic. Ebilling had reached a point where invoicing was no longer simple. The increase of alternative fee arrangements and a departure from simple hourly billing is the major reason for these changes. This new format can handle taxes more effectively, there is room for more data and this format is superior for foreign jurisdictions. One segment was added to the previous LEDES XML 2.0 version. It is: Regulatory Statement |

UTBMS

What is UTBMS?

UTBMS stands for Uniform Task Based Management.

UTBMS created a coding system to assign a single code to each activity, task or expense that may appear on an invoice. Prior to UTBMS, descriptions of services rendered could take up multiple paragraphs or pages. The American Bar Association, The Association of Corporate Counsel and PricewaterhouseCoopers worked together to create consistency by implementing this unified electronic billing standard. The standard designed to enable enforcement of a corporate legal department’s Outside Counsel Billing Guidelines and make the job of the bill reviewer substantially easier.

What are UTBMS Codes?

UTBMS codes are used to classify legal services and expenses performed by a law firm or vendor. The codes correspond to specific tasks, activities or expenses. These codes are entered in LEDES data format, oftentimes causing individuals to call them “LEDES codes”. There are several sub-sections of code sets. Within these sets, you can select high-level codes or very specific codes. Below is the list of all of the standard code sets:

- Activity Codes

- Bankruptcy Codes

- Counseling Codes

- E-Discovery Codes

- Expense Codes

- GRC

- IP

- Litigation

- Mergers & Acquisitions

There are also some jurisdiction specific codes.

What is the benefit of adopting UTBMS Codes?

UTBMS Codes have huge potential in terms of controlling costs for your organization. Your company will be able to see how much time firms are spending on certain activities and which timekeepers are billing which activities. You will always want the lowest cost individual doing the most basic activities (for example: Copying).

Utilizing UTBMS Codes enables you to collect data and track billing information. With this information you can compare legal services and expenses. This thorough type of documentation will substantially improve your legal spend analysis. Your company can then compare similar matters and better evaluate the performance of your firms. Oftentimes this forces firms to be more transparent regarding their billing practices and often leads corporate legal departments to narrow-down the list of firms they engage with.

Summary & Examples

Benefits of adopting LEDES & UTBMS:

- Ease of use.

- Consistency in formatting simplifies the process of using various e-billing solutions for law firms.

- Universal formatting that improves the invoice review process

- UTBMS codes enable improved spend analysis.

- Data can be interpreted to determine where to control cost.

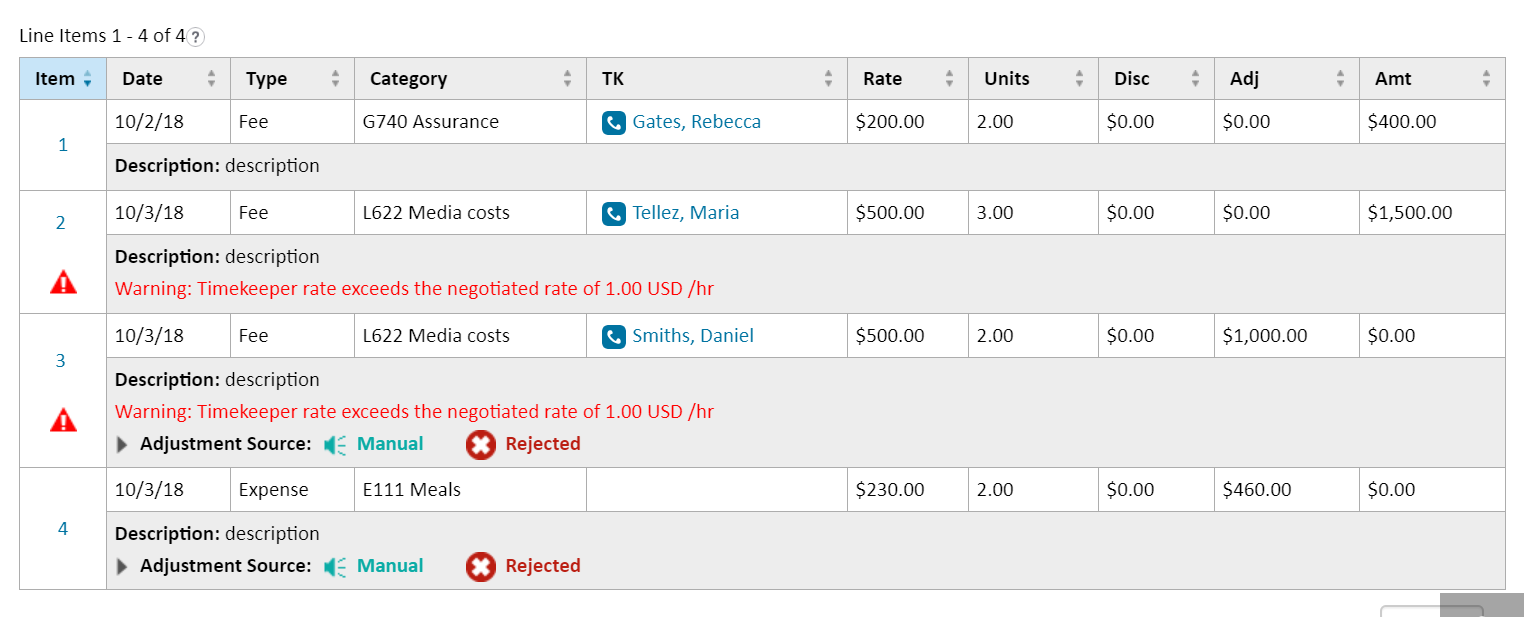

Your system will be able to analyze this information and compare invoices to your company’s billing guidelines. See example below:

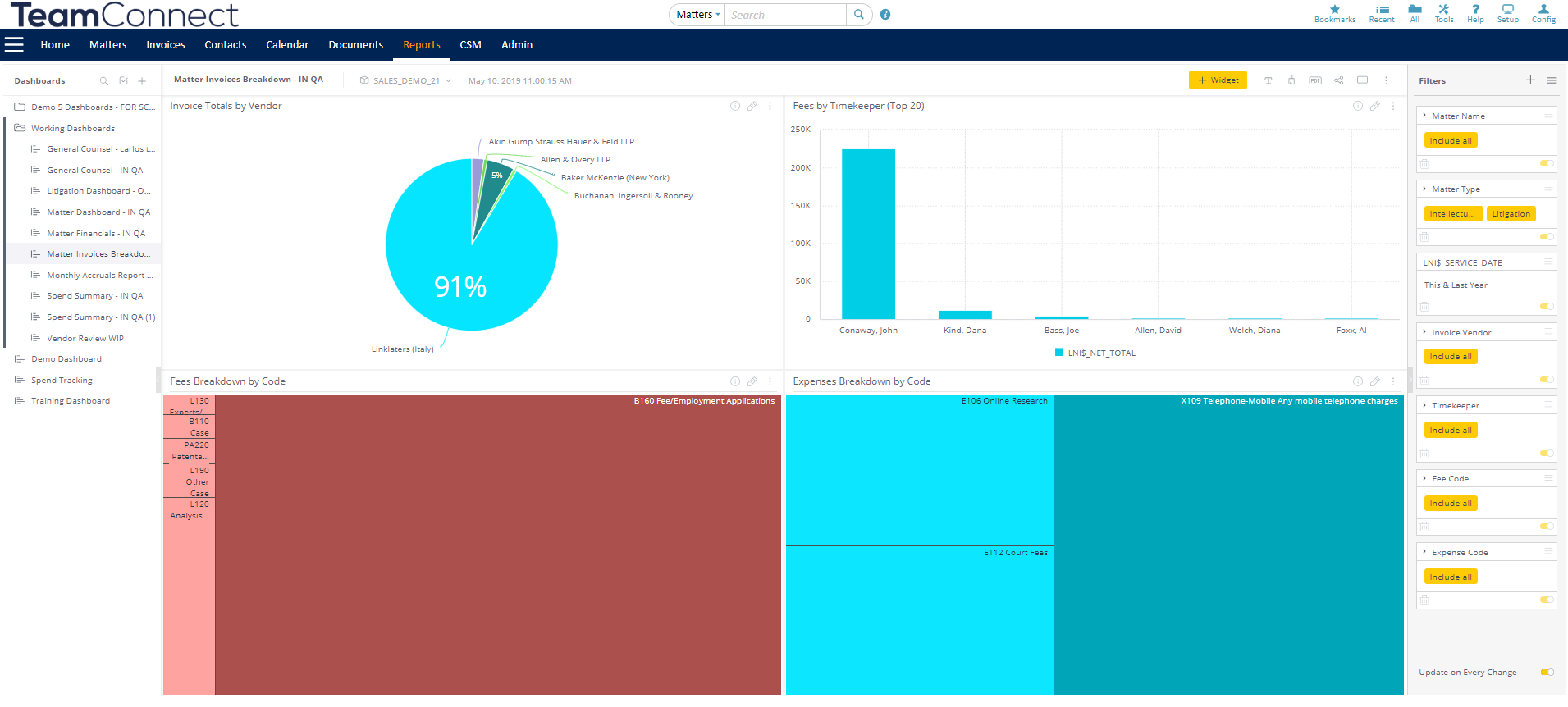

In TeamConnect you are able to use your Reporting Dashboards to analyze spend using the information from the LEDES files your firms have submitted through the system.