eBilling Rules and Guidelines

What are Invoice Audit Rules?

One of the main benefits of an eBilling solution is the automated auditing of invoices against company and firm-specific billing guidelines. A list of comprehensive, best-practice rules exists in TeamConnect Enterprise that allows users to optimize their electronic invoice import process to automatically reject, automatically adjust, or flag with a warning line items in an invoice that do not conform to the set billing guidelines (audit rules).

Setting billing audits and communicating those to your firms ensures you are both clear on billing expectations. By using billing audits, you can identify firms that consistently follow billing guidelines as well as those who don’t and avoid billing discrepancies such as duplicate invoices and charges. Billing audits reduce outside counsel costs, increase billing efficiency and promote better communications with outside counsel.

Audits performed in the eBilling portal

Mitratech’s eBilling portal is Collaborati.

Before your legal department receiving an electronic invoice, audits are performed within Collaborati. These basic audits are in place to eliminate invoices received and reviewed by your legal department that contain basic billing errors.

These audits are applied to both electronic invoices uploaded into Collaborati as well as invoices manually created in Collaborati.

| Audit Name | Description |

| Syntax Validation | The LEDES invoice uploaded by a vendor conforms to LEDES format |

| Data Type Validation | The data submitted is in the correct format (for example, dates are submitted in a date format) |

| Client Validation | The client has approved the vendor to bill to that matter |

| Invoice Number | Invoice number is specified and represents a unique ID against the vendor invoice data already present in Collaborati |

| Date Validation | Invoice dates are specified, valid, and chronologically consistent |

| Validation of Line Item Units | Required line item unit values are specified (for example, number of hours is entered on the invoice) |

| Validation of Codes |

All codes used in the invoice and existing codes and authorized by the client Learn more about LEDES eBilling codes here. |

| Validation of Timekeepers | All timekeepers specified in the uploaded file are existing timekeepers and authorized by the client |

| Validation of Line Item Totals | The total line item amount is consistent with the rate and unit values |

Note: Click here to see the online User Guide for Collaborati.

Where can I enable or disable the audit rules (available under Billing Profiles) in TeamConnect?

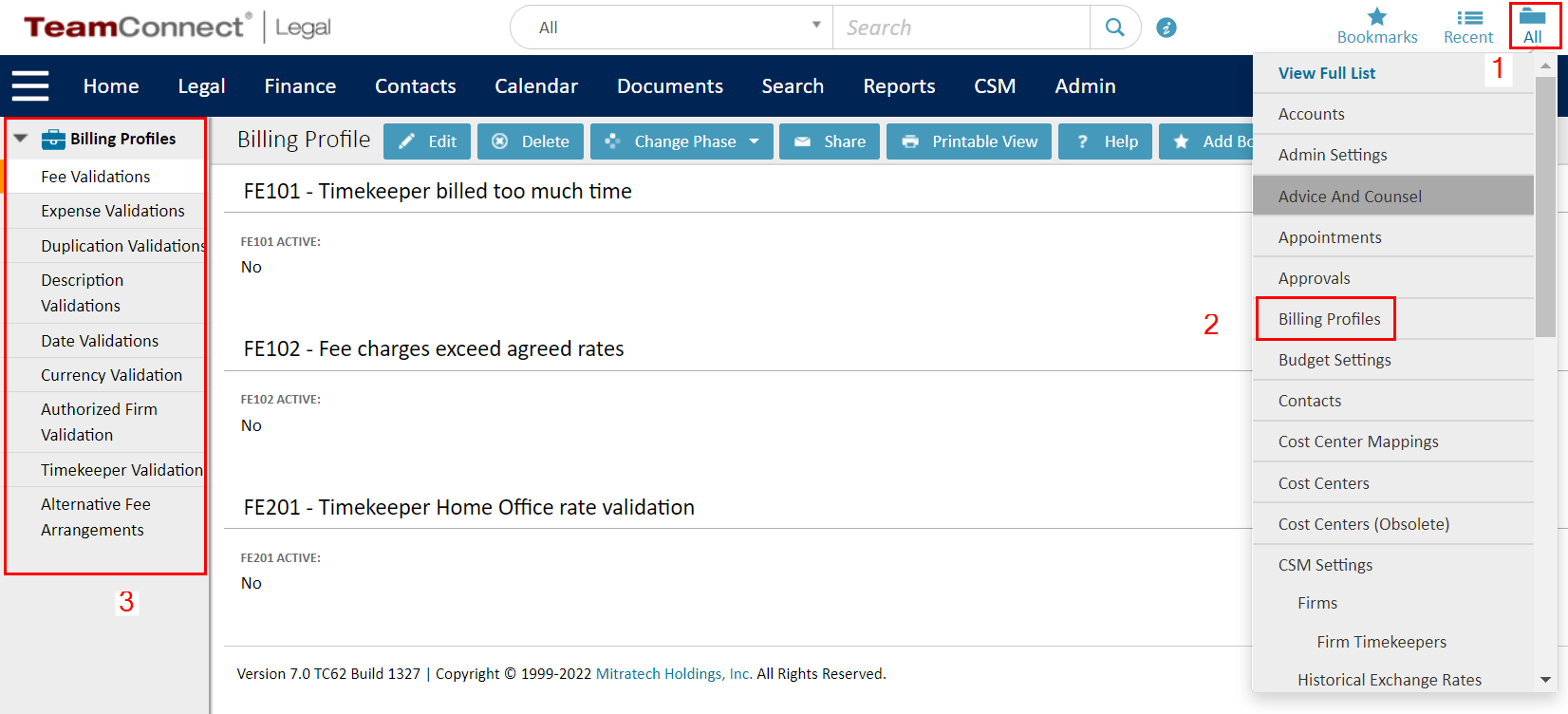

You must be an eBilling Admin to enable or disable the eBilling rules. To edit, log in as an administrator, select the All menu then select Billing Profiles.

Click the Edit button to enable or disable the respective rules.

Invoice Audit Rules Index

The table below defines all of the rules that ebilling and CSM administrators can enable or disable for invoices.

Note: Every Billing Profile needs to identify when the rule is applied: Create, Update, both Create and Update, Delete, Approval (Phase Change).

| Billing Profile & Description | Audit Rules & Definitions |

|

Fee Validations |

|

|

Expense Validations

|

|

|

Duplication Validations |

|

|

Description Validations |

|

|

Date Validations |

|

|

Currency Validation |

|

|

Authorized Firm Validation |

Missing Firm Contact - Validates whether the Office is associated or not to an Authorized Firm |

| Timekeeper Validation | TK101- Flag Timekeeper as Diverse By default, this rule is inactive. Must have one field selected to activate this rule. Based on the client configuration, even if at least one selected field is applicable then Timekeeper will be marked as diverse.

Note: Upon configuring this rule, it shall mark all new timekeepers as diverse and non-diverse. A background job runs to check and mark the existing timekeeper(s) as diverse if applicable. Users cannot edit any of these settings till the background job ends. |

| Rate Request Validation |

Rate Request Validations has validation rules to handle the Timekeeper Rate Currency Selection features in Collaborati. This Rate Request Validations contains three validation rules that help in validating the Rate Requests. The Validation rules are given below

|

Analysis of Timekeeper Overbilling Hours Warnings

| Instructions | Screenshot for reference |

Note: Make sure to enable the option to check this limit across all invoices. |

When an invoice is synced to TeamConnect from Collaborati, the Timekeeper's work hours are validated across all invoices for the specified involved party, with error messages displayed at the line item level as needed.

The first line item and Timekeeper are validated against other invoices in the system using date, timekeeper, typeId, and vendor as matching criteria.

If there are additional line items across other invoices that match by date, timekeeper, typeId, and vendor, their hours will be added to the total hours for that Timekeeper.

Timekeeper Overbilling Hours Warnings

The FE101 Billing Profile is triggered when an invoice is Created, Updated, Posted, or Adjusted. Line item adjustments will also trigger FE101. As a result, the following warnings may be appended due to these triggering events.

|

Timekeeper billing hours exceed the maximum limit on the same invoice |

Timekeeper billing hours exceed the maximum limit on the same invoice - scenario with more than 3 line items on the invoice |

Timekeeper billing hours exceed the maximum limit across multiple invoices |

Warning Messages |

|

Yes |

No |

No |

Warning: Timekeeper daily time entry exceeds the maximum allowed time of 8.00 hrs on the current invoice (line item 1). |

|

Yes |

Yes |

No |

Warning: Timekeeper daily time entry exceeds the maximum allowed time of 8.00 hrs on the current invoice (line items 1, 2, 3, ...). |

|

Yes |

Yes |

Yes |

Warning: Timekeeper daily time entry exceeds the maximum allowed time of 8.00 hrs on: Invoice 101 (line items 1, 2), Invoice 102 (line items 1, 2), Invoice 105 (line items 1, 2, 3, ...), Invoice 108 (line items 1, 2, 3), Invoice 112 (line item 1), ... . |