Create a Credit Note

Collaborati allows you to create Credit Notes. Please check with your client before submitting a Credit Note to determine if they are allowed by your client.

To start creating the Credit Note:

-

Hover over “Invoices” in the top menu bar.

-

Click on “Create Invoice”.

-

Click "Bill Invoice As" to choose the correct Office from the dropdown menu.

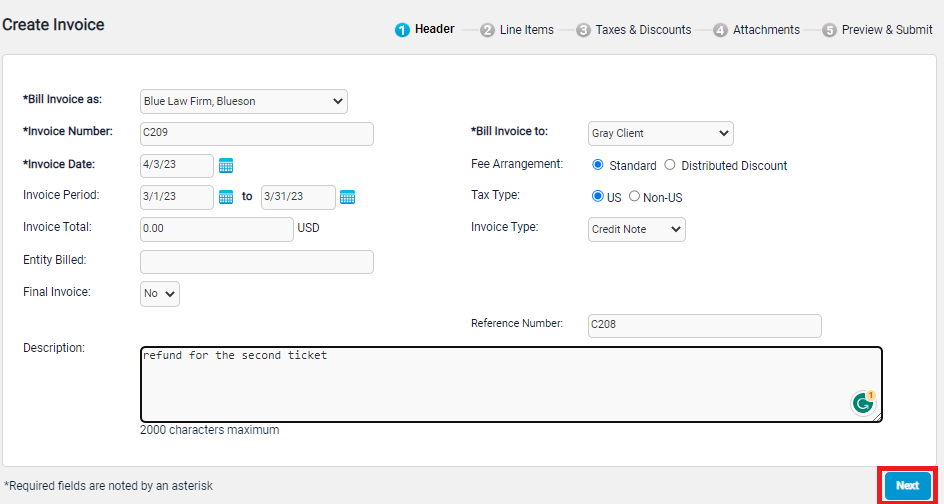

HEADER

Fill in pertinent information. Most clients require the Invoice Period. Invoice Date must be after Invoice Period. It is recommended to leave the Invoice Total at $0.00 as Collaborati will automatically add the amount. The Invoice Type is “Credit Note.” Place a brief description of the invoice in the Description box. You may also want to enter the Reference Number. (In the example below, the Reference Number refers to the original invoice.)

Click "Next"

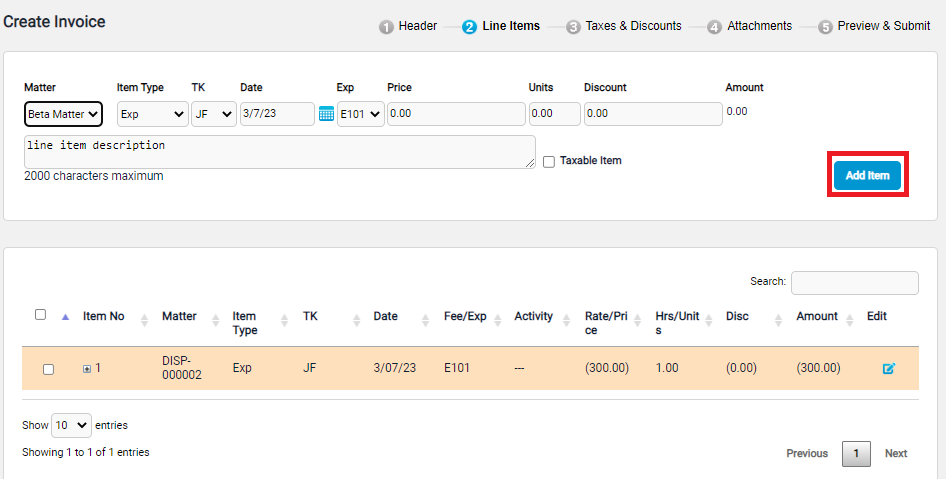

LINE ITEMS: Fee or Expense

Select your Matter from the drop-down list.

- Item Type is Fee.

- TK is the timekeeper.

- Fee is the code from your Task Codes list.

- Activity is the code from your Activity Codes list.

- Rate is the hourly rate of the timekeeper used (authorized by the client).

- Hours is the amount of time the timekeeper worked on the matter.

- A description of the fee should be typed into the Description box.

For Expenses, no Timekeeper is required and you must select the proper Expense code.

- Item Type is Exp.

Note that the Amount is Negative.

Click on the Add Item button to finish the line item fee or expense.

Click "Next"

TAXES AND DISCOUNTS

If you are applying discounts to the invoice, here is where you apply your discount by % on Fees and/or Expenses.

Taxes are applied at the % of the Taxable items.

Click "Next"

ATTATCHMENTS

Use the "Browse" button to search for the document that you wish to attach.

After you have found the document, click on the "Attach Files" button. The attached document will appear in the attachment section.

Click "Next"

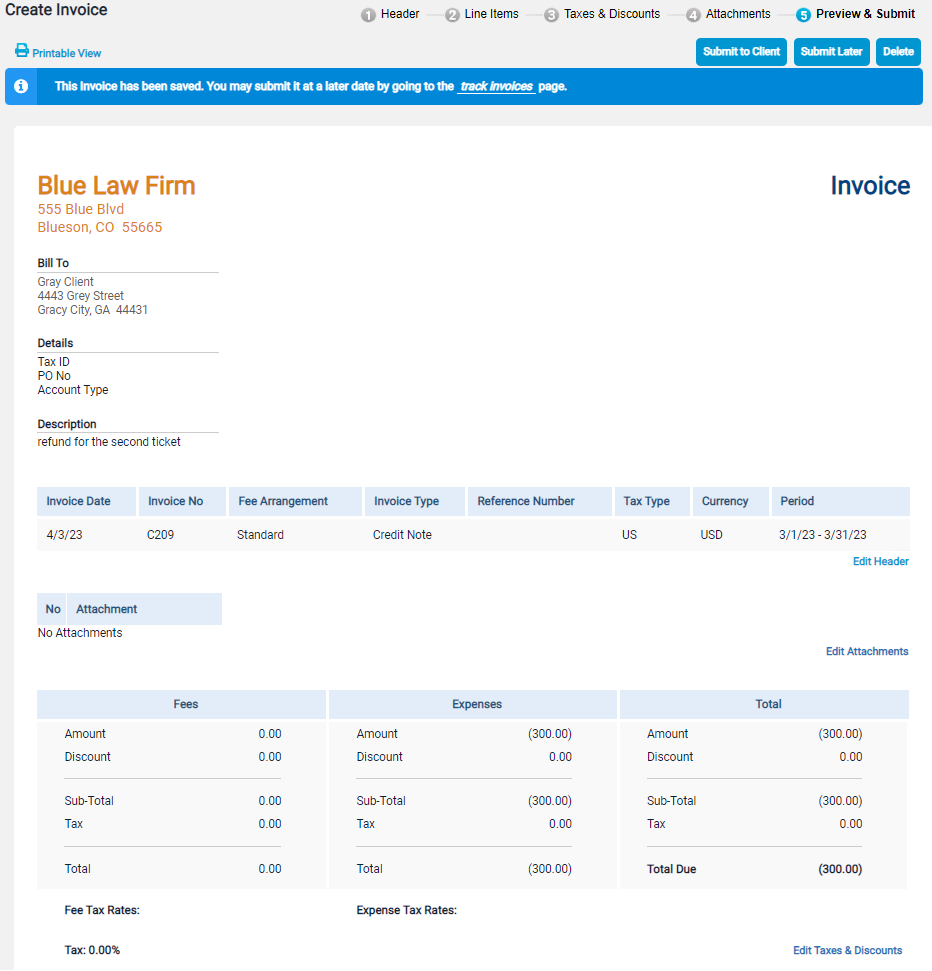

PREVIEW: Completed Invoice

The Credit Note is now ready to submit to the client.

Note: The amount should be negative, but this could depend on the client, as the client may not use budgeting/accounts. Accounts are set up to accept a negative amount on a Credit Note (in the same way as a negative amount on an Invoice). However, some clients do not allow negative invoices. In this case, a small credit (or negative line item) should be added to a larger invoice.