Adding/Calculating VAT Tax

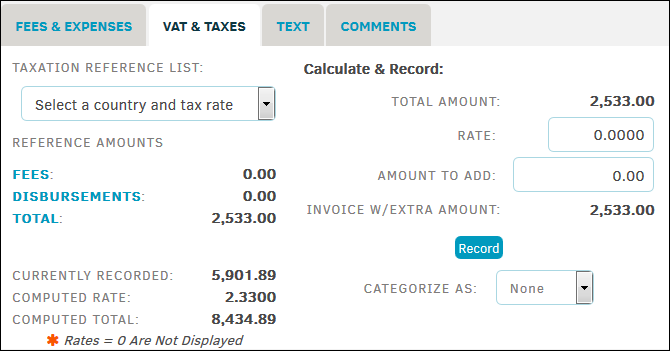

The VAT & Taxes tab (located in the middle of the main invoice page) allows you to take the tax rate for a geographic region and multiply that rate against:

- The entire matter amount

- Fee (hourly) items only

- Disbursement (expense) items only

To calculate the value added tax (VAT) for an invoice:

- Click the VAT & Taxes tab on the invoice main page.

- Click one of the Reference Amounts (i.e. Fees, Disbursements, Total) to distinguish what type of tax you are adding.

-

Select the appropriate country from the Taxation Reference List drop-down menu. The "Rate" and "Amount to Add" fields update automatically based on the selection. You can also manually type an amount into these fields.

-

Select a category, such as Tariff or General, from the "Categorize As" drop-down list.

-

Click Record to save.

-

Select Here to see the recorded amount.

- To adjust more amounts within this tab, click Edit Tax/VAT. Your previously adjusted amounts show under "Currently Recorded", "Computed Rate", and/or "Computed Total".