Collaborati Client On-boarding Process

This page details the prerequisites and process for the Collaborati client on-boarding process.

Prerequisites

The following steps include business and technical prerequisites:

- Subscribe to COLLABORATI.

- For details, contact your Mitratech account manager.

- Provide your Mitratech account manager with an email address at your organization to be used for notifications related to COLLABORATI setup.

- Provide your Mitratech account manager with a list of vendors to add to e-billing. The list must contain each vendor's country code, default currency, name, Tax Id, address, and a vendor contact person's email address so that vendors can receive email notifications related to Collaborati registration.

- You can add additional vendors at any time by contacting your Mitratech account manager.

- Create a contact record in Lawtrac for each vendor. Verify that each vendor's contact has been added as an involved party, in active status, to the appropriate matter records.

- Before running COLLABORATI Synchronization, confirm that Lawtrac is setup properly to avoid conflict with COLLABORATI behavior or generate sync errors.

- Verify that Lawtrac's task codes, expense codes and activity codes that are used for Lawtrac and Collaborati reflect the values you want your vendors to use by doing the following:

- Tab to the My Lawtrac link from the upper left area of Lawtrac.

- Select Application and Administration from the My Lawtrac drop-down list.

- Next to the Legal Department tab, click Finance Options.

- From the menu to the right, click LEDES Codes link.

- Verify that the appropriate task codes are displayed in the LEDES CODES & PROCESSING RULES table on the screen.

- Click the Other / Custom tab.

- Add any other Custom LEDES Codes that need to be used for e-billing.

- Click on any individual LEDES Code if you wish to restrict it or require it for use.

- For new Lawtrac installations, determine the appropriate Fiscal Year used for the application by selecting the Fiscal Year link within the Finance Options tab.

- This setting is extremely important as it determines to what fiscal year incoming electronic invoices from Collaborati are associated.

- From the Processing Rules page within the Finance Options tab of Application Administration, click on Advanced Processing Rules. Click on TIME & DATE CHECKS and locate processing rule R501. Confirm that the rule is checked and select one of the four radio buttons: PERIOD FROM DATE, PERIOD TO DATE, INVOICE DATE or DATE INVOICE RECORDED, with default value on INVOICE DATE. This setting determines which date field should be used to properly set the Fiscal Year and Fiscal Quarter on a law firm's invoice.

- See the Advanced Processing Rules page for more detail on all of the rules and their implications in the system.

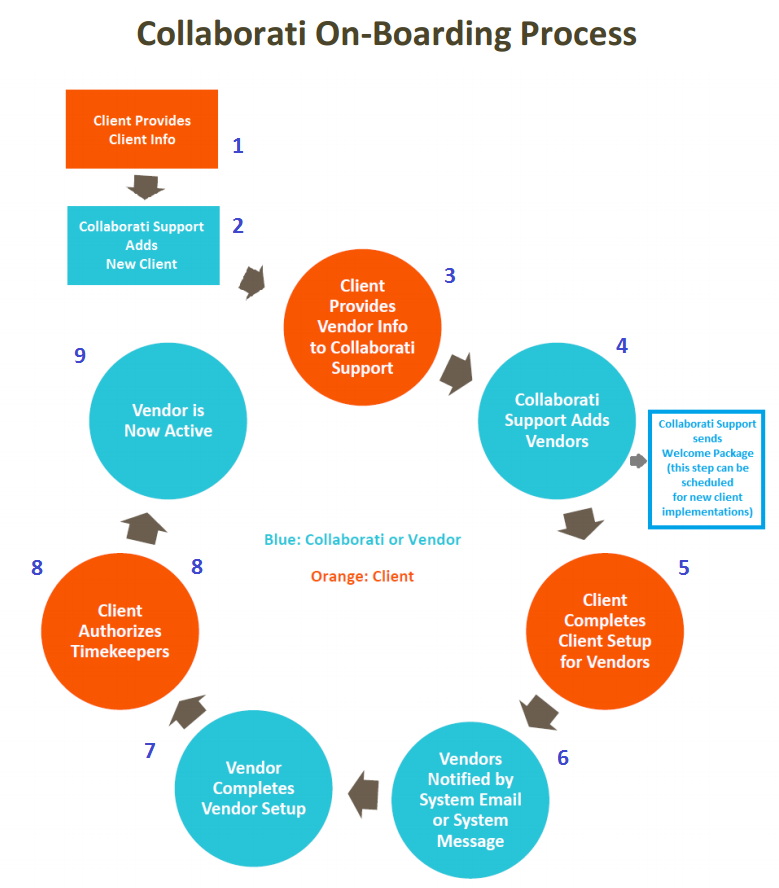

The image below provides a visual representation of the Collaborati on-boarding process.