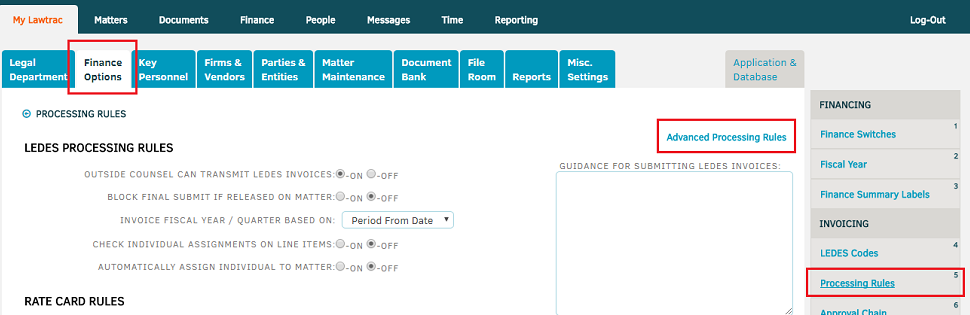

Advanced Processing Rules

Lawtrac administrator users manage the advanced processing rules for the Lawtrac application via Application Administration | Finance Options | Processing Rules | Advanced Processing Rules. These rules apply to LEDES invoices submitted through Lawtrac as well as all invoice types received through Collaborati. For law firms and vendors who use Collaborati, the advanced processing rules apply after the invoice has been received by Lawtrac at the time of synchronization.

Note: Current Lawtrac behavior also applies advanced processing rules to LEDES invoices submitted manually in Lawtrac. Regular processing rules do not apply to invoices submitted to Lawtrac through Collaborati. One exception is ALL DISBURSEMENT ITEMS TO COMPANY RATE CARD setting in Lawtrac, which allows vendors to submit expense line items without timekeepers.

Advanced Processing Rules Defined

R100: Block If Released.

Note: R100 (block invoices from released firms) is not applicable, because Collaborati requires that the firm is assigned to a matter in order to submit an invoice.

R101: Check individual timekeeper assignments.

R102: Automatic timekeeper assignment.

R200: Validate timekeeper rate card.

Note: See the R200 Matrix at the bottom of this page to view various scenarios in which this rule would be applied if it is enabled/disabled.

R201: Validate task code maximum amount per invoice.

R202: Hours or Count Threshold.

R203: Check maximums at the matter level check.

R204: Check restricted task codes.

R205: Check required codes.

R300: Check duplication of specific lines within an invoice.

R400: Measure Invoice-to-combined budget per matter - Not supported in Collaborati.

R401: Measure Invoice-to-firm's budget per matter – Not supported in Collaborati.

R402: Measure Invoice-to-fiscal reserves per matter – Not supported in Collaborati.

R500: Work within invoice's "From/Start" and "To/End" dates.

R501: Ensure invoices reflect fiscal year settings. This is a very important Rule as this defines the Fiscal Year of the invoice being submitted.

(For example: Client 2018 FY is defined as 02/01/2017 to 01/31/2018)

If an invoice is submitted: Line Item 1: Period From Date: 12/01/2016; Period To Date: 01/31/2017; Invoice Date: 02/01/2017; Date Invoice Recorded (synced in Lawtrac): 02/02/2017.

If R501 is checked at the Period From Date checkbox, at the time of synchronization, the invoice will be compared to the timekeeper rate card for FY 2017, as Period From Date on the invoice line item is set to 12/01/2016.

However, if R501 is checked at the Invoice Date checkbox, at the time of synchronization, the invoice will be compared to the timekeeper rate card for FY 2018, as the Invoice Date on the invoice line item is set to 02/01/2017.

R502: Set penalties for late reporting.

R503: Account for inconsequential events.

R504: Flag line items billing 10+ hours per day/timekeeper/invoice/matter.

R600: Flag non-billable disbursements by word or phrase.

R601: Flag non-billable fees by word or phrase.

R602: Negate fees for non-billable disbursements.

R603: Negate fees for non-billable fees.

R200 Matrix

When enabled, the R200 Rule has several options for users to chose from: Reject, Adjust, Warn, and Off. Only one option can be selected at a time. The tables below detail various scenarios and system behaviors for the various R200 options:

| If R200 Rule is Checked | ||||

| Option Selected | Scenario: Not approved Timekeeper rate in Invoice | Scenario: Approved Timekeeper rate (no violations) | Scenario: Approved Timekeeper rate, but invoice line item submitted above approved rate | Scenario: Invoice line item submitted below approved Timekeeper rate |

| Off | Invoice goes through, no warnings or adjustments | Invoice goes through, no adjustments from R200 | Invoice goes through, always adjust offending lines to approved rate | Invoice goes through, no adjustments from R200 |

| Adjust | Invoice goes through, lines with no approved rates are adjusted to 0 | Invoice goes through, no adjustments from R200 | Invoice goes through, always adjust offending lines to approved rate | Invoice goes through, no adjustments from R200 |

| Warn | Invoice goes through, lines with no approved rates are flagged | Invoice goes through, no adjustments from R200 | Invoice goes through, always adjust offending lines to approved rate | Invoice goes through, no adjustments from R200 |

| Reject | Invoice is auto-rejected, Lawtrac will not have record of this invoice | Invoice goes through, no adjustments from R200 | Invoice goes through, always adjust offending lines to approved rate | Invoice goes through, no adjustments from R200 |

| If R200 Rule is Unchecked | ||||

| Option Selected | Scenario: Not approved Timekeeper rate in Invoice | Scenario: Approved Timekeeper rate (no violations) | Scenario: Approved Timekeeper rate, but invoice line item submitted above approved rate | Scenario: Invoice line item submitted below approved Timekeeper rate |

| Off | N/A | Invoice goes through, no adjustments from R200 | Invoice goes through, no adjustments from R200 | Invoice goes through, no adjustments from R200 |

| Adjust | N/A | Invoice goes through, no adjustments from R200 | Invoice goes through, no adjustments from R200 | Invoice goes through, no adjustments from R200 |

| Warn | N/A | Invoice goes through, no adjustments from R200 | Invoice goes through, no adjustments from R200 | Invoice goes through, no adjustments from R200 |

| Reject | N/A | Invoice goes through, no adjustments from R200 | Invoice goes through, no adjustments from R200 | Invoice goes through, no adjustments from R200 |