Add Taxes to Line Items While Creating an Invoice

You can specify taxes for line items for both tax types. Refer to the following pages to see what you need to enter on each page of the invoice, depending on the type of tax you select.

For additional information about creating an invoice, refer to How do I create an invoice in Collaborati?.

To add line item taxes to invoices with a U.S. Tax Type

Use the following pages to add line item taxes to invoices with a US tax type.

Adding Line Item Taxes for a US Tax Type

|

Invoice Page |

Adding Line Item Taxes |

|---|---|

|

Header |

Select U.S. as the Tax Type. |

|

Line Items |

Enter information for a line item, and select the Taxable Item checkbox. |

|

Taxes & Discounts |

Under Taxes, enter the tax rate without the "%" sign. |

To add line item taxes to invoices with a Non-U.S. Tax Type

Use the following pages to add line item taxes to invoices with a non-US tax type. For additional information about how to create an invoice with Line Item Tax with helpful screenshots, click here.

Note: You cannot add line item level taxes for the Non-U.S. tax type if clients do not have line item tax details enabled for their system.

Adding Line Item Taxes for a Non-US Tax Type

|

Invoice Page |

Adding Line Item Taxes |

|---|---|

|

Header |

Select Non-U.S. as the Tax Type, and select Line Item Level from the options that appear. |

|

Line Items |

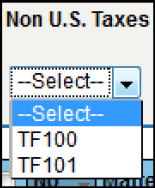

Enter information for a line item, and select a tax code from the Non U.S. Taxes drop-down list.

If you want to add another tax code to the line item, click Note: If a tax code you want to add is not available from the drop-down, contact your client to add the code to your list of approved tax codes. |

|

Taxes & Discounts |

Under Taxes, enter a tax rate value for each tax code that you added to line items on the Line Items screen. |

to add additional entries, and select a different tax code from the drop-down list. Click

to add additional entries, and select a different tax code from the drop-down list. Click  to delete an entry.

to delete an entry.