Exception Basics

What is an Exception?

Exceptions are violations of a client’s billing guidelines and rules. They are divided into two categories: Critical and Non-Critical. Critical Exceptions must be resolved by a firm before an invoice can be submitted to a client for review. For video instructions on exceptions, see How to Review Exceptions

Firms are notified of exceptions immediately after uploading an invoice; firms also receive an upload confirmation email with the same notice.

Critical Exceptions

Critical Exceptions are violations of billing guidelines or billing rules that must be resolved before an invoice status can be changed to For Approval. Examples of common Critical Exceptions include:

-

Timekeeper Rate is Incorrect

-

Exact Duplicate Line Items

-

Invalid Code/Date/Service Period

-

Expense Requires Back Up Documentation

Non-Critical Exceptions

Non-Critical Exceptions are issues which the client has asked Acuity to flag for their review. A Non-Critical Exception on a line item does not necessarily mean that there is anything wrong with that line item; instead, it may be a task that the client wants highlighted to make their review more efficient.

Examples of common Non-Critical Exceptions include:

-

Travel Expenses Will Be Reviewed

-

Possible Duplicate Line Items

-

Invoices Submitted After Matter Close Will be Reviewed

-

Invoice Within 75% of Matter Budget

Note: For video instructions on viewing rules, see How to View Rules

Resolving Exceptions

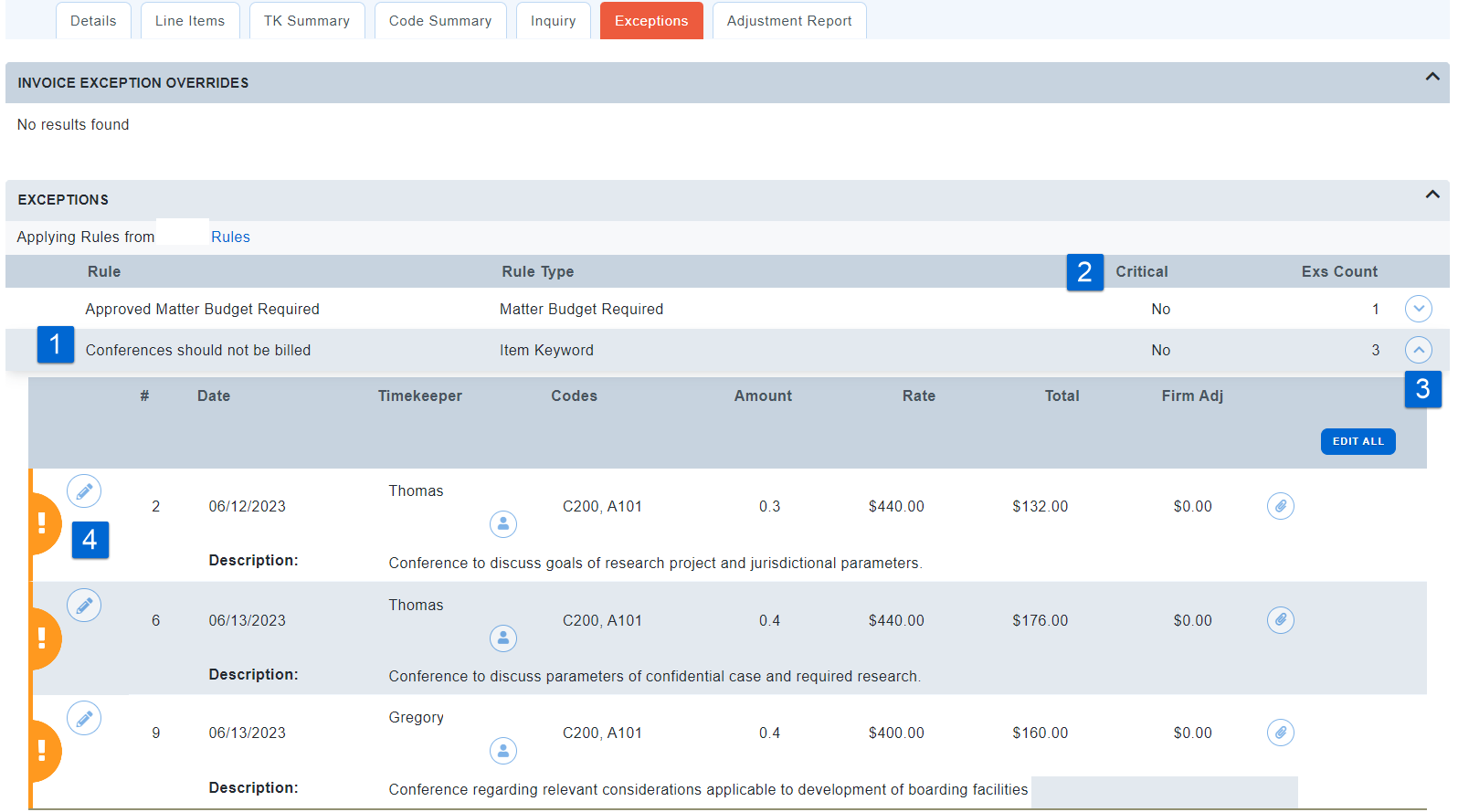

All Exceptions are displayed on the Exceptions tab. Line Items with exceptions may be edited there or on the Line Items tab.

On the Exceptions Tab

-

Exceptions are grouped by type.

-

Display indicates whether an exception is critical or non-critical.

-

Display provides a count of line items with that exception; click the chevron to expand the selection to show all impacted line items.

-

Edit the line item using the

icon; if there are multiple lines, use

icon; if there are multiple lines, use  .

.

-

Save edits. The exception status will update.

Acuity Tip:

- If the Exceptions says 'Expired' in the Invoice Profile click