Manually Creating an Invoice

When manually creating an invoice to be submitted using Corridor, each invoice can only pertain to a single matter. If multiple matters are needed, you must create multiple invoices.

To Create an Invoice:

-

Login to the Corridor Website. Administrators, managers, and invoice submitters can submit invoices.

-

Click on the client company on your home page.

-

On the Invoices: Electronic Submission page, click the Manual Submission link and select Create New.

-

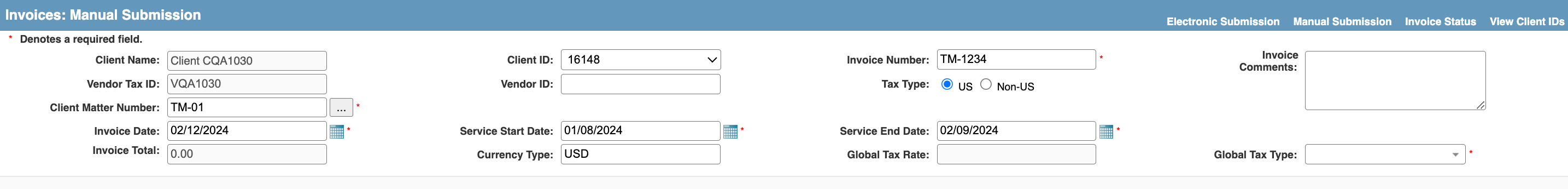

On the Invoices: Manual Submission page, select the identifier for the client from the Client ID menu.

![]() If a client ID is not available, an Administrator or Manager can add the client ID to Corridor. To add a client ID, click on the View Client IDs link on the title bar on the Invoices: Manual Submission page. If you are an Invoice Submitter, contact an Administrator or Manager to add the client ID.

If a client ID is not available, an Administrator or Manager can add the client ID to Corridor. To add a client ID, click on the View Client IDs link on the title bar on the Invoices: Manual Submission page. If you are an Invoice Submitter, contact an Administrator or Manager to add the client ID.

-

Enter the following information:

| Field | Description |

| Client Name | The client name fills automatically when you select the client company. |

| Client ID | Select the client ID from the drop-down list. |

| Invoice Number | The identifier for the invoice. It can contain letters, numbers, and dashes. |

| Invoice Comments | Invoice comments are optional. |

| Vendor Tax ID | The vendor tax ID fills automatically when you select the client company. |

| Vendor ID | The identifier for the site. Enter the Vendor ID only if there are multiple vendor locations. This identifier must match the identifier for your firm used by the client company in the matter management app. |

| Tax Type | Select US or Non-US. |

| Client Matter Number |

The identifier for the client matter. This identifier must match a valid matter number in the client's matter management application for the invoice to be transmitted properly. If the client company has synchronized matters with Corridor, click the ... button to select from a list of matters for which the law firm/vendor is a current player in eCounsel. |

| Line Item Type |

Select one option from Line Item Type. This option applies to all the line items that you need to enter for the manual invoice.

Hybrid lets you enter taxed and non-taxed items. |

| Invoice Date | Click the  Calendar button to select a date. Calendar button to select a date. |

| Service Start Date | Click the  Calendar button to select the start date. Calendar button to select the start date. |

| Service End Date | Click the  Calendar button to select the end date. Calendar button to select the end date. |

| Invoice Total |

It fills automatically when you enter line items. |

| Currency Type |

The type of currency. The default value is USD (United States Dollar). Currency Type must match the currency type for your firm used by the client company in the matter management application. |

| Global Tax Rate |

If the invoice is subject to taxes and the client company has enabled tax support, Global Tax Rate field appears on the page. Type the percentage as a decimal number (for example, a tax of 8.75 percent is entered as .0875) of the fees/expenses that are taxed in the Tax Rate text box. Taxes can only be entered for a single jurisdiction. |

| Global Tax Type | After you select Global Tax Rate, the Global Tax Type activates as a dropdown list. Select the tax type that applies to the invoice. |

After you fill the invoice data, create Line Items:

-

In the Invoice Details area, click the

New button to enter line item information for the invoice. At least one line item must exist to submit the invoice.

New button to enter line item information for the invoice. At least one line item must exist to submit the invoice. -

On Manual Submission: Invoice Detail, enter information for the line item. The fields vary depending on whether Detail Type is Fee, Expense, or Invoice-level Discount. The following tables describe the fields that you must enter depending on the Detail Type option.

| Fee Invoice Detail | |

| Field | Description |

| Detail Type |

Fee is selected. |

| Date of Charge (Required) | Enter the date of the charge. |

| Timekeeper ID | Enter the client's timekeeper ID. |

| Task Code | Select the task code from the drop-down list. |

| Activity Code | Select the activity code from the drop-down list. |

| Tax Type | If Tax Type is Non-US in Invoices: Manual Submission, enter all applicable tax types. The form allows you to create multiple tax types. |

| Tax Rate | If Tax Type is Non-US in Invoices: Manual Submission, enter all applicable tax rates associated to the tax type. The form allows you to create multiple tax types with their associated tax rates. |

| Charge Type | Select Unit Price or Fixed Charge. |

| Units (Required) | If Charge Type is Unit Price, enter the units charged. |

| Timekeeper Rate (Required) | Enter the timekeeper rate. |

| Base Amount (Required) | Units times Timekeeper Rate. This is automatically filled. |

| Discount Amount | If a discount is applied, enter it as a negative amount. |

| Total Amount (Required) | The discount subtracted from the base amount. This is automatically filled. |

| Tax Amount | If the client company has enabled tax support, Tax Amount appears on the form. If applicable, you must manually apply the tax rate to the base amount of the line item and enter this amount in the Tax Amount text box. |

| Charge Description (Required) | Enter a description of the charge. |

If you select Tax Type as Non-US in Invoices: Manual Submission, you can enter multiple tax types and their associated tax rates.

- Click on the plus icon to add more fields.

- Click on the trash icon to delete fields.

| Expense Invoice Detail | |

| Field | Description |

| Detail Type | Expense is selected. |

| Date of Charge (Required) | Enter the date of the charge. |

| Timekeeper ID | Enter the client's timekeeper ID. |

| Expense Code | Select the expense code from the drop-down list. |

| Charge Type | Select Unit Price or Fixed Charge. |

| Units (Required) | If Charge Type is Unit Price, enter the units charged. |

| Rate (Required) | Enter the timekeeper rate. |

| Base Amount (Required) | Units times Rate. This is automatically filled. |

| Discount Amount | If a discount is applied, enter it as a negative amount. |

| Total Amount (Required) | The discount subtracted from the base amount. This is automatically filled. |

| Tax Amount | If the client company has enabled tax support, Tax Amount appears on the form. If applicable, you must manually apply the tax rate to the base amount of the line item and enter this amount in the Tax Amount text box. |

| Charge Description (Required) | Enter a description of the charge. |

| Invoice-level Discount Detail | |

| Field | Description |

| Detail Type | Invoice-level Discount is selected. |

| Date of Charge (Required) | Enter the date of the discount. |

| Timekeeper ID | Enter the client's timekeeper ID. |

| Discount Type (Required) | Select Flat or Percent. |

| Discount Amount | Enter as a negative amount. |

| Charge Description (Required) | Enter a description of the discount. |

-

Click Save or click Save/New to enter another line item. Click Close when you have entered all line items. Click Yes to close the window.

![]() If a required field is not entered, Corridor will prompt you to enter the information before you can save the line item.

If a required field is not entered, Corridor will prompt you to enter the information before you can save the line item.

Follow this procedure to submit a manually created Invoice:

-

On the Invoices: Manual Submission page, click Continue.

![]() If a required field is not entered, Corridor will prompt you to enter the information before you can continue.

If a required field is not entered, Corridor will prompt you to enter the information before you can continue.

-

Click OK on the message box that informs you that it is recommended you save a copy of the invoice to your local disk drive. In order to correct a manually entered invoice in the event of a business rule rejection, you must save a copy of the invoice and use the steps in Correcting a Manually Entered Invoice to resubmit the invoice.

-

Select the location to which you want to save the file, then click Save.

![]() Corridor uses the following naming convention for all saved invoice files: Corr<Invoice_Number>YYYYMMDDHHMM.XML, where <Invoice_Number> is the text entered in the Invoice Number field, YYYY is the four-digit year, MM is the two-digit month, DD is the day, and HHMM is the time the file was created using a 24-hour clock (military time). Even if a file is renamed during the save process, Corridor will refer to the file using the internal naming convention above (on the Invoice: Status page).

Corridor uses the following naming convention for all saved invoice files: Corr<Invoice_Number>YYYYMMDDHHMM.XML, where <Invoice_Number> is the text entered in the Invoice Number field, YYYY is the four-digit year, MM is the two-digit month, DD is the day, and HHMM is the time the file was created using a 24-hour clock (military time). Even if a file is renamed during the save process, Corridor will refer to the file using the internal naming convention above (on the Invoice: Status page).

-

Additional validations are performed that do not prevent the invoice file from being submitted (however, submitting with these errors may cause the invoice(s) to be rejected according to the client company's billing guidelines):

-

The line item total must equal (rate * units) + discount amount + tax total (if the line item includes a discount and tax).

-

The invoice total must equal the sum of all line items.

-

The invoice billing start date must be before the invoice billing end date, and all line items must be within the invoice billing date range.

-

The following LEDES fields will be checked to contain a value: Units (fees and expenses), Rate (fees and expenses), and Timekeeper ID (fees only).

Optionally check the Ignore validation errors checkbox to submit the file with any of the additional error validations found.

-

If the client company has configured the matter management application to accept attachments to invoices, add attachment(s), such as receipts, to the file by invoice on the Invoices: Manual Submission page. Click Attach next to the invoice and browse to the attachment. Attachments are allowed a maximum total size of 20 MB per submission. To remove an attachment before submission, click Remove next to the attachment name.

-

Click the Submit LEDES File button.