How do I create an Accrual Invoice in Collaborati

Note, the process of "accrual" invoices is intended to provide early forecast billing information. An "accrual" invoice is often followed by submission of a "standard" invoice. Check your client's billing guidelines for requirements.

Accrual Invoices

Step-by-step guide to creating accruals and submitting monthly accruals within Collaborati. Begin by logging in to Collaborati.

To start creating your invoice, follow these steps:

- Hover over “Invoices” in the top menu bar

- Click “Create Invoice”

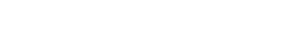

Header Information

Fill in pertinent Header information.

- Choose Accrual from the Invoice Type field in the invoice header.

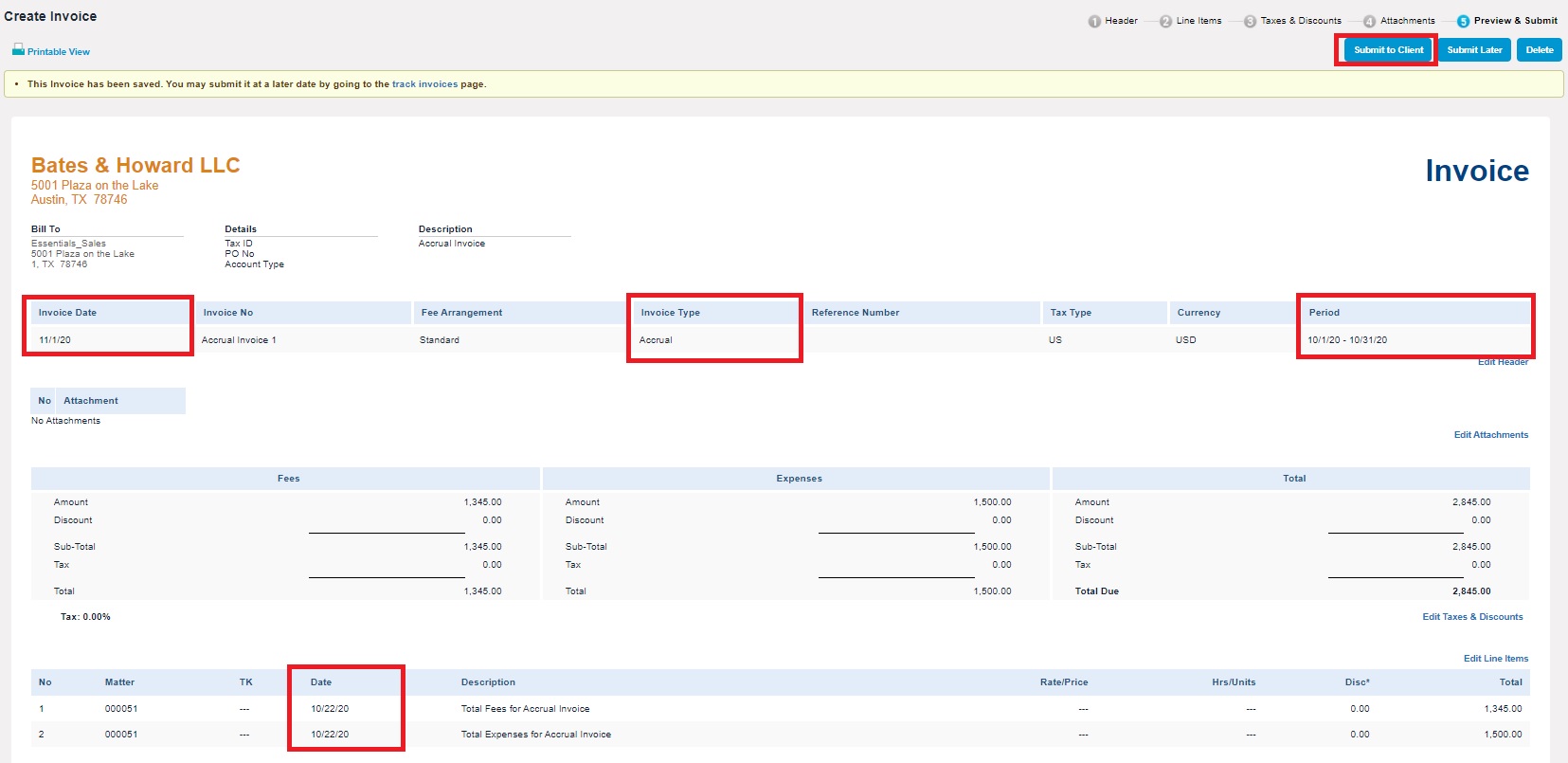

Note: If the Accrual choice in Invoice Type is not shown, report the problem to the client. - “Invoice Date” must occur after “Invoice Period”. (Note the Invoice Date can be a date in the future.)

Example: If I am submitting October’s Accrual on 10/16/2020,

I can enter the Invoice Date as a date next month, 11/1/2020

And the Invoice Period as 10/1/2020 – 10/31/2020

Recommendation: We recommend leaving “Invoice Total” at $0.00 as Collaborati will automatically add the amount.

- Place a brief description of the invoice in the “Description”.

- Click Next.

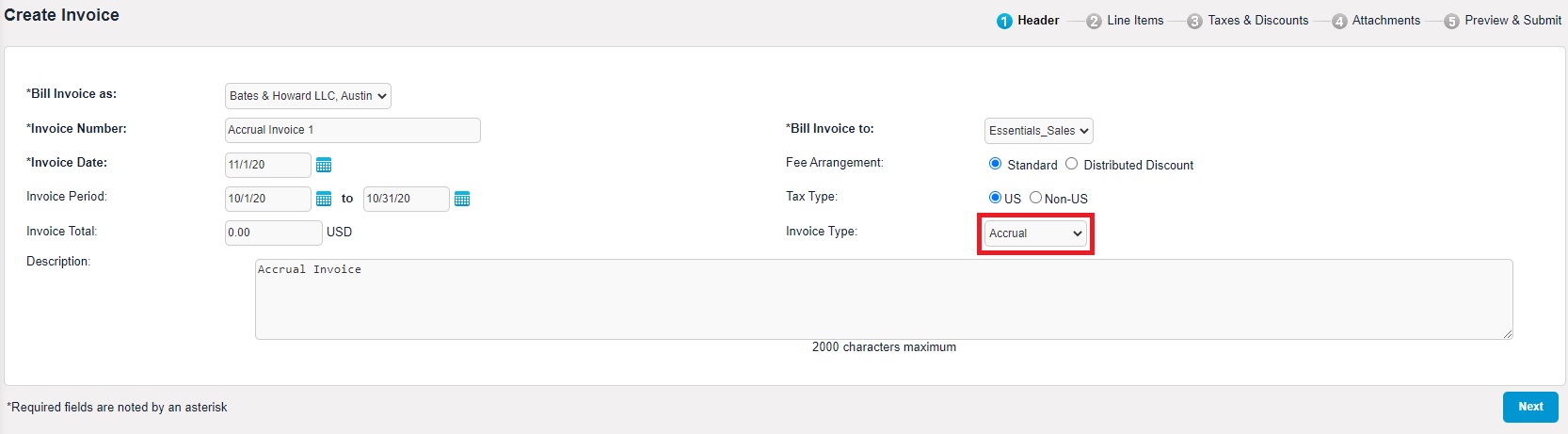

Line Items

You can enter a one line accrual which will include estimated fees and expenses, or you can enter a two line accrual to separate the fees and expense. Below is an example with two lines.

Fee

- Select your Matter.

- Choose Total Fee in the Item Type drop-down menu.

- Enter the line item date.

Important: Ensure the start date on the line item is within the Invoice Period.

- Enter the Amount (Please check with client do they add an amount?)

- Click Add Item.

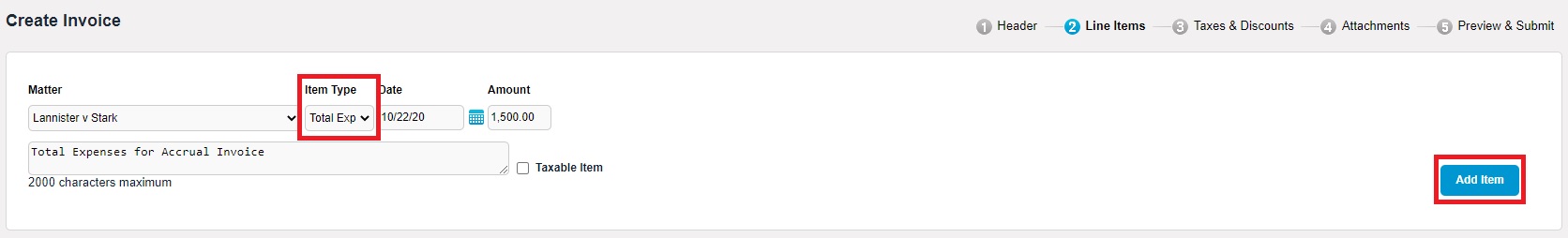

Expense

- Select your Matter.

- Choose Total Expense in the Item Type drop-down menu.

- Enter the line item date.

IMPORTANT: Ensure the start date on the line item is within the Invoice Period.

- Enter the Amount (Please check with client do they add an amount?)

- Click Add Item.

- Review the line items and click Next.

Taxes & Discounts and Attachments

- Taxes & Discounts (you can skip this section)

Click "Next".

- Attachments (you can skip this section)

Click "Next".

Review and Submit

Review the accrual invoice for accuracy. If everything looks correct, the invoice is ready to submit to the client.