Create a LEDES 1998B File with Non-US Tax

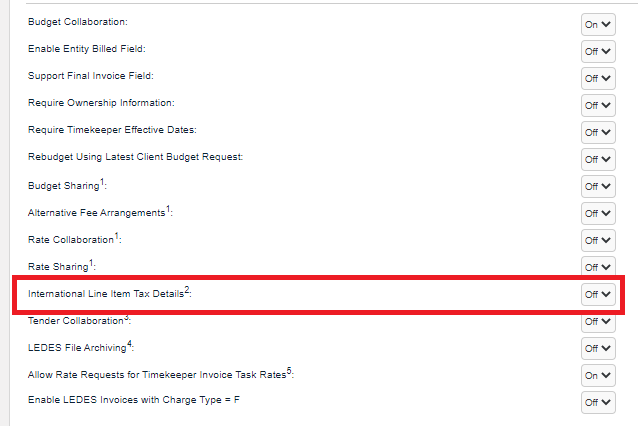

To submit LEDES98B file with Non-US Tax, you must check if your client has the feature "International Line Item Tax Details" set to OFF.

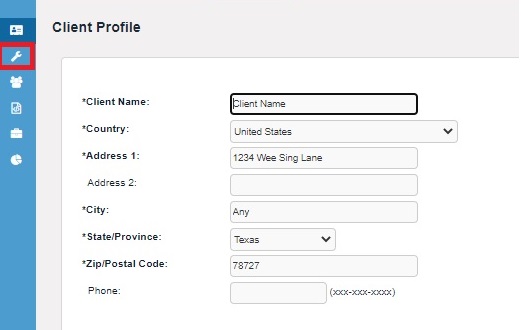

1. Click the "Clients" tab.

2. Either search for the client or click the name of the client.

3. Click the "Settings" sub-navigation link for that client.

4. In the Settings page, locate International Line Item Tax Details

If the International Line Item Tax Details setting is ON, then you cannot use LEDES98B file with Non-US Tax Codes. To find which formats do allow for Non-US Tax Codes, see below.

If the International Line Item Tax Details setting is OFF, see the information below:

How to create LEDES98B files with Non-US Taxes

Note: Detailed specifications for fields in the LEDES98B file format can be found in LEDES98B Format Specifications. Those specifications contain comments about how the fields work within Collaborati.

Enter line items as usual. Then enter one or more extra rows in the file to contain tax amounts. Create one tax row in the file for each combination of matter / line item type / Non-US Tax category that is included in the invoice. In addition to the regular data requirements for LEDES files, note the following additional requirements for each Non-US Tax row:

- If a category relates to Fees, use value "F" in field EXP/FEE/INV_ADJ_TYPE and put the Non-US Tax code for fees in field LINE_ITEM_TASK_CODE.

- If a category relates to Expenses, use value "E" in field EXP/FEE/INV_ADJ_TYPE and put the Non-US Tax code for expenses in field LINE_ITEM_EXPENSE_CODE.

- In either case, put the total tax amount for that matter and category into field LINE_ITEM_TOTAL.

Note: This does not work for Clients using “International Line Item Tax Details”

To create LEDES98BI V2 files with Non-U.S. Taxes

The LEDES98BI V2 format contains all the fields that are in the LEDES98B format, plus additional fields. For detailed specifications of the additional fields, see LEDES98BI V2 Format Specifications. Those specifications contain comments about how the fields work within Collaborati.

You must include information for Non-U.S. Tax in the same row as a line item. Note the following additional requirements for these fields:

line_item_tax_total: Enter the Non-U.S. Tax amount in this field; note this value can be zero

line_item_tax_type: Enter the authorized Non-U.S. Tax code in this field

invoice_reported_tax_total: Enter the sum of line_item_tax_total values for the same invoice

invoice_tax_currency: Enter a 3-character ISO currency code as defined in the ISO 4217 specification

To create LEDES XML 2.0 and XML 2.1 files with non-U.S. taxes

The following field has an additional requirement:

@TAX.tax_type: Enter a client-authorized Non-U.S. Tax code.

For more information on these and other LEDES XML 2.0 or XML 2.1 fields, see LEDES XML 2.0 Format or LEDES XML 2.1 Format.

What LEDES formats allow Non-US Tax?

Formats that DO use Non-US tax are:

LEDES1998B (only applicable for Clients not using the setting International Line Item Tax Details; see above)

LEDES 98BI V2 (currency can be specified on this format; Non-US tax code must be entered)

LEDES XML 2.0 (currency can be specified on this format; Non-US tax code is optional)

LEDES XML 2.1 (currency can be specified on this format; Non-US tax code is optional)

Formats that DON'T use Non-US tax:

LEDES 2000 (allows US Tax as a percentage; currency can be specified on this format; no "Non-US tax" code allowed)